📌 Key Takeaways

Payment terms determine when cash moves, and a 15-day shift can materially change your working capital needs over a year.

- Trade Credit Structures Control Cash Flow: Net 30, Net 45, or Net 60 terms define when invoices are due in full, directly affecting whether suppliers or buyers fund the gap between delivery and payment.

- Early Payment Discounts Create Flexibility: A 2/10 Net 30 structure allows buyers to capture a 2% discount by paying within 10 days while keeping the full 30-day option available, giving both sides choice without forcing rigid timelines.

- Milestone-Based Advances Build Trust Gradually: Starting with 25% advance on first orders, reducing to 10% after three clean shipments, then moving to open account eliminates risk incrementally as both parties prove reliability.

- Credit Limits Plus Triggers Prevent Disputes: Setting a maximum exposure (e.g., $50,000) with automatic reviews based on on-time payment rates (≥95% upgrades, <85% reverts) creates objective criteria that both sides understand before problems arise.

- Evidence-Based Term Changes Preserve Relationships: Proposing extensions backed by payment history, volume commitments, and forecast visibility turns negotiations from confrontation into collaborative problem-solving where both sides trade value.

Terms that align with your cash cycle reduce overdraft reliance and free capital for growth.

Kraft paper suppliers and buyers in B2B trade will find practical scripts here, preparing them for the detailed negotiation frameworks that follow.

Most payment term guides list options and explain structures. This one hands you the actual words—field-ready phone scripts, email templates, and objection replies—organized by who you are and what you need. Whether you’re a supplier seeking faster cash-in or a buyer negotiating more days, you’ll find copy-and-paste language that preserves relationships while addressing the cash-flow realities both sides face.

Why Terms Matter in Paper

Payment terms determine when cash moves. For suppliers, terms control how quickly revenue converts to working capital. For buyers, they govern how long finished goods can generate revenue before supplier invoices come due.

In kraft paper trade, most transactions use some form of trade credit—a business-to-business arrangement where goods are delivered now and paid later. Common shorthand such as Net 30, Net 45, or Net 60 simply means the invoice is due in full within that many days after the invoice date. The gap between delivery and payment creates strain somewhere in the chain.

Finance teams often measure this timing pressure using the cash conversion cycle (CCC)—the number of days between paying suppliers and collecting cash from customers. A longer CCC means more working capital tied up; a shorter CCC frees cash for growth and resilience.

The typical pattern creates pressure for both sides. Suppliers often pay for pulp, energy, and freight well before they collect from buyers. Meanwhile, buyers face their own customer receivables stretching to 60–90 days. If a supplier extends Net 30 while the buyer collects at 60 days, that 30-day gap must be funded with cash or overdraft.

Illustrative Example: Suppose a supplier delivers kraft paper on January 1 with Net 60 terms. Payment arrives March 2. The buyer sells finished boxes on January 15 with Net 90 customer terms. Customer payment arrives April 15. The buyer paid the supplier 44 days before their customer paid them. That gap demands bridge financing or cash reserves.

These examples are illustrative, not guidance. Actual cycles vary by product, volume, and relationship history. The principle remains: shorter gaps reduce financial friction for the party funding the difference.

Pick Your Ask: A Quick Menu by Situation

Before you draft a script, identify what you need and what you can offer in return. The table below maps common situations to term structures worth proposing.

For Suppliers (Need Faster Cash):

- Situation: New buyer, unknown credit → Consider: Advance + balance or letter of credit

- Situation: Proven buyer, want to accelerate → Consider: Early payment discount (2/10 Net 30)

- Situation: Large initial order, high risk → Consider: Milestone payments tied to production stages

For Buyers (Need More Days):

- Situation: Proven track record with supplier → Consider: Request Net 45 or Net 60 from current Net 30

- Situation: Seasonal cash pressure → Consider: Temporary extension with reversion clause

- Situation: Willing to commit volume → Consider: Trade longer terms for volume commitment or forecast visibility

Early payment discounts follow a simple pattern. A 2/10 Net 30 structure means the buyer receives a 2% discount if payment arrives within 10 days; otherwise, the full amount is due in 30 days. This gives suppliers an option to accelerate cash while giving buyers flexibility.

Examples only. The right structure depends on your cash cycle, the counterparty’s risk tolerance, and the competitive alternatives each side faces.

Scripts for Suppliers (Cash-in Sooner, Risk Lower)

Phone Openers

Script 1: Move from Net 45 to Net 30

Purpose: Accelerate cash collection with an established buyer

When to use: After 3–5 successful orders with no payment delays

The words: “Hi [Buyer Name], I wanted to discuss our payment timeline. We’ve completed five orders together over the past four months with consistent on-time delivery and zero quality issues. I’d like to propose moving to Net 30 terms going forward. This helps us manage working capital more predictably, and in return, I’m happy to lock in our current pricing for the next six months. Would you be open to testing Net 30 on the next two orders?”

Give/Get:

- Give: Price stability, volume commitment, continued reliability

- Get: 15 days faster payment, improved cash flow

Follow-up: If they agree, send a formal Order Acknowledgment or Contract Addendum within 24 hours that explicitly references the new payment terms and pricing lock, ensuring it supersedes previous conflicting terms.

Script 2: Swap Price Hold for Early Payment Discount

Purpose: Incentivize faster payment without cutting headline price

When to use: When buyer requests a price hold but you need faster cash

The words: “I understand you’d like to hold pricing flat for the next quarter. I can do that, and I’d like to offer an early payment option as well. If you pay within 10 days of the invoice, we’ll apply a 2% discount. That gives you flexibility—take the full Net 30 if you need it, or capture the discount if your cash position allows. Does that structure work for your team?”

Give/Get:

- Give: Price certainty, optional discount

- Get: Faster payment from buyers who can afford it, maintained headline price for those who can’t

Follow-up: Confirm the discount mechanics in writing: invoice date, payment receipt date, and how the discount will appear on future invoices.

Script 3: Request Partial Advance on First Orders

Purpose: Reduce risk exposure on initial orders with new buyers

When to use: First order with an unknown buyer, especially for large volumes

The words: “Thank you for the order. For first-time buyers, our standard practice is to request a 25% advance with the balance on delivery. This helps us manage production costs and ensures both sides are committed to the order. After we complete the first two orders successfully, we’re happy to move to open account terms. Does that work for your procurement process?”

Give/Get:

- Give: Clear path to open account terms, commitment to relationship

- Get: Risk mitigation, cash to cover raw material costs

Follow-up: Provide a proforma invoice for the advance, specify the timeline for balance payment, and document the transition criteria to open account.

Script 4: Cap Exposure with Credit Limit

Purpose: Keep total receivables under control with growing buyer

When to use: Rapidly scaling customer with increasing order frequency

The words: “To keep your supply steady while managing our exposure, can we agree on a credit limit of [amount]? Any orders beyond that limit would be covered by a partial advance until we review and potentially increase the limit based on payment history. This lets us support your growth without overextending our credit lines.”

Give/Get:

- Give: Continued supply priority, clear path to limit increases

- Get: Controlled risk exposure, documented review process

Follow-up: Document the limit in writing, specify review frequency (quarterly is common), and define performance criteria for limit increases.

Email Templates

Template 1: First Order with New Buyer

Subject: Payment Terms for Order #[Number] – Initial Order Process

Hi [Buyer Name],

Thank you for your order dated 2026. We’re excited to work with you.

For first-time orders, we structure payment as follows:

- 25% advance upon order confirmation

- 75% balance upon delivery (or against document presentation if shipping internationally)

Once we’ve successfully completed two orders together, we’ll transition to Net 30 open account terms. This approach has worked well for us and our buyers—it builds trust while managing initial risk for both parties.

I’ve attached a proforma invoice for the 25% advance. Please confirm receipt, and we’ll begin production as soon as the advance clears.

Looking forward to a successful partnership.

Best regards, [Your Name]

Template 2: Request Terms Change with Repeat Buyer

Subject: Payment Terms Discussion – Proposal for Net 30

Hi [Buyer Name],

Over the past six months, we’ve completed eight orders together with zero payment delays and consistently positive feedback on quality. I’d like to propose adjusting our payment terms from Net 45 to Net 30.

This change helps us manage cash flow more effectively, and in return, I’m prepared to:

- Lock current pricing through 2026

- Prioritize your orders during high-demand periods

- Maintain our current delivery lead times

I’m suggesting we trial Net 30 for the next three orders and review the arrangement in early [month]. If it creates any challenges for your finance team, we can discuss adjustments.

Let me know your thoughts.

Best regards, [Your Name]

Template 3: Pilot-to-Scale-Up Payment Structure

Subject: Payment Terms for Scale-Up Orders – Proposed Structure

Hi [Buyer Name],

Thank you for confirming the scale-up from pilot to regular production volumes. I’d like to propose a payment structure that aligns with the increased order size:

For orders 1–3 (scale-up phase):

- 15% advance on order confirmation

- Balance Net 30 from delivery

For orders 4+ (regular production):

- Net 30 open account, no advance required

This structure gives us confidence during the scale-up while building toward a streamlined process once volumes stabilize. I’m also happy to set a quarterly business review to discuss volumes, quality, and any term adjustments.

Does this work for your team?

Best regards, [Your Name]

Objection Handling

Objection: “We can’t prepay—our finance policy doesn’t allow it.”

Response: “I understand finance policies can be strict, especially for new vendors. A few of our other buyers have worked around this by processing the advance as a deposit rather than a prepayment, which sometimes falls under different approval rules. Alternatively, we could structure this as a 10% deposit with the balance on delivery, which may be easier to approve internally. Would either of those approaches work within your policy?”

Objection: “Our policy caps payment terms at Net 30 for all suppliers.”

Response: “I appreciate that—standardization makes finance processes more manageable. Net 30 works for us. If there’s flexibility on volume commitments or forecast sharing, we could explore pricing adjustments that offset the faster payment. For example, if you’re able to commit to monthly minimums, we can usually offer 2–3% better pricing. Would that be worth exploring?”

Objection: “We’re in a year-end finance freeze and can’t change vendor terms right now.”

Response: “That’s completely understandable—year-end is tight for everyone. I’d like to propose we sign a deferred amendment now with a firm effective date of [first day of new fiscal year]. This allows your finance team to secure the approval now while scheduling the actual system update for after the freeze lifts. We’ll continue on current terms until then. Does that timing work better?”

Objection: “If advances are not possible, can we limit shipment sizes?”

Response: “Absolutely. If advances don’t fit your policy, we can work within a smaller credit window by starting with smaller shipment sizes. Once we build more payment history together, we can gradually increase order sizes and adjust terms accordingly.”

Objection: “Your credit insurer is cautious about our company.”

Response: “I understand credit insurers can be conservative with newer relationships. We’re open to starting with lower credit limits and increasing them gradually as we demonstrate consistent performance. We can also provide additional documentation—trade references, forecasts, financial statements under NDA—to support your insurer’s review process.”

Plain-Language Clauses

The following clause examples are illustrative only and must be reviewed under company policy and local law before use.

Clause 1: Early Payment Discount

“If Buyer submits payment within 10 calendar days of invoice date, Seller will apply a 2% discount to the invoice total. Discount eligibility is determined by the date payment is received in Seller’s account, not the date payment is initiated. This discount is optional; Buyer may pay under standard Net 30 terms without penalty.”

Clause 2: Evidence-Based Release for Advance Payment

“Seller will release goods upon receipt of: (1) Certificate of Analysis confirming specification compliance, (2) complete shipping documentation, and (3) irrevocable credit of the advance payment into Seller’s nominated bank account, confirmed by Seller’s bank. Release typically occurs within 2 business days of all conditions being met.”

Clause 3: Credit Limit with Automatic Review

“Buyer’s credit limit is set at [amount] and will be reviewed quarterly on [month/month/month]. If Buyer maintains on-time payment (≥95% of invoices paid within terms) for two consecutive quarters, Seller will automatically increase the credit limit by 20%. Credit limit may be adjusted downward if payment performance drops below 85% on-time rate.”

Scripts for Buyers (More Days, Predictable Cash)

Phone Openers

Script 1: Request Net 45 After Establishing Track Record

Purpose: Extend payment terms from Net 30 to Net 45 after proving reliability

When to use: After 4–6 clean orders with zero disputes or late payments

The words: “Hi [Supplier Name], I wanted to talk about our payment arrangement. We’ve completed six orders together over four months with no late payments and zero quality disputes. Our customer payment cycles run 60–75 days, and moving to Net 45 terms would help us align cash flow better. In return, I can commit to minimum monthly volumes of [amount] for the next six months and provide you with a rolling 90-day forecast. Would you be open to testing Net 45 for the next quarter?”

Give/Get:

- Give: Volume commitment, forecast visibility, proven reliability

- Get: 15 additional days to convert inventory to cash before supplier payment is due

Follow-up: Send written confirmation of the new terms, the volume commitment, and the review date. Include a sample of your forecast format.

Script 2: Request 2/10 Net 30 Structure

Purpose: Gain flexibility while offering the supplier faster payment option

When to use: When you have periodic cash availability but need flexibility

The words: “I’d like to propose a 2/10 Net 30 structure for our orders. When our cash position allows, we’ll pay within 10 days and take the 2% discount. When we need the full Net 30, we’ll use that without penalty. This gives us flexibility while giving you the option for faster cash when we can manage it. We typically pay early about 40% of the time based on our current cash cycle. Does that structure interest you?”

Give/Get:

- Give: Faster payment 40% of the time, continued orders

- Get: Flexibility to extend payment when needed, cost savings when paying early

Follow-up: Clarify how the discount will be applied (automatic vs. manual request) and confirm invoice date calculation.

Script 3: Staggered Milestone Payments

Purpose: Tie payment to inspection checkpoints for large or complex orders

When to use: First orders with a new supplier, especially for high-value or custom specifications

The words: “Given the size of this order and the custom specifications, I’d like to propose a milestone-based payment structure: 20% on order confirmation, 30% on production completion before shipping, and 50% on delivery after our quality inspection passes. This aligns payment with progress and gives both of us checkpoints to confirm we’re on track. After we complete this order successfully, we can move to standard Net 30 terms. Does that work for you?”

Give/Get:

- Give: Partial cash flow during production, clear quality gates

- Get: Risk reduction, alignment of payment with value delivered

Follow-up: Document each milestone’s definition (e.g., “production completion” means finished goods ready to ship, evidenced by photos or COA), payment timing, and inspection criteria.

Script 4: Request Open Account After Trial Period

Purpose: Transition from cash-heavy advance structure to open account

When to use: After 3–5 clean, on-time payments under advance terms

The words: “We’ve now completed four orders with full and timely payment under the advance structure. To make our cash cycle more predictable going forward, can we move the next set of orders to open account terms at Net 30, with a reasonable credit limit and quarterly review? This would streamline operations for both of us.”

Give/Get:

- Give: Proven payment reliability, commitment to continued volume

- Get: Elimination of advance requirement, improved working capital

Follow-up: Propose a specific credit limit based on typical monthly order values, and suggest a first review date three months out.

Email Templates

Template 1: New Supplier Introduction with Terms Request

Subject: Order Inquiry and Payment Terms Discussion

Hi [Supplier Name],

We’re evaluating suppliers for and your mill came highly recommended. I’d like to discuss a potential trial order and payment terms.

For new supplier relationships, we typically start with small trial orders (2–5 tons) to validate quality and lead times. Our standard procurement terms are Net 45, which aligns with our customer payment cycles.

If you’re able to work within Net 45 terms for the trial order, we’d like to move forward with specifications and pricing. Assuming the trial goes well, we’d look to establish regular monthly orders of [volume range].

Are you open to Net 45 terms for a trial order? If there are constraints on your end, I’m happy to discuss alternatives like a smaller advance or 2/10 Net 30 structure.

Looking forward to your thoughts.

Best regards, [Your Name]

Template 2: “Good-History” Terms Extension Request

Subject: Payment Terms Adjustment Request – Net 60 Proposal

Hi [Supplier Name],

We’ve been working together for eight months now, and I wanted to reach out about our payment terms. We’ve maintained a clean payment record with zero late payments and have grown our monthly volume from [X] to [Y] tons.

Our customer base has shifted toward longer payment cycles (60–75 days), and I’d like to request an extension from Net 45 to Net 60 to better align our cash conversion cycle.

In return, I’m prepared to:

- Commit to minimum monthly volumes of [amount] for the next year

- Provide 90-day rolling forecasts by the 15th of each month

- Maintain our current on-time payment record

I’m suggesting we implement this for a six-month trial period and review the arrangement in [month]. If it creates cash flow challenges for you, we can discuss volume adjustments or a smaller extension (e.g., Net 50).

Let me know your thoughts.

Best regards, [Your Name]

Template 3: Seasonal Extension Request

Subject: Temporary Payment Terms Extension – Q4 Seasonal Request

Hi [Supplier Name],

As we head into our Q4 peak season, I’d like to request a temporary extension of our payment terms from Net 30 to Net 45 for orders placed between [start date] and [end date].

Our Q4 customer demand spikes significantly, but customer payments lag into Q1. This seasonal extension would help us manage the cash flow gap during peak production.

To make this work for both sides, I’m proposing:

- Extension applies only to Q4 orders (approximately [number] orders)

- Automatic reversion to Net 30 on 2026

- 10% volume increase during the extension period (from [X] to [Y] tons per month)

If a full 15-day extension isn’t feasible, I’m open to discussing a smaller extension (Net 37–40) or a staggered approach.

Let me know if this works for you.

Best regards, [Your Name]

Template 4: Strategic Partnership Framing

Subject: Long-Term Partnership and Payment Structure

Hi [Supplier Name],

We see you as a strategic supplier for our kraft paper needs and expect our volumes to grow significantly over the next 12–18 months. To plan working capital properly on both sides, I’d like to propose a structured payment arrangement.

Proposed Framework:

- Net 45 terms on contracted monthly volumes

- Defined credit limit: [amount]

- Quarterly business reviews to discuss volume, quality, and potential term adjustments

- 90-day rolling forecasts provided by the 15th of each month

This structure gives both of us predictability and room to grow the relationship. I’m happy to share our projected volumes and discuss any adjustments that would make this more workable for your finance team.

Can we schedule a call to finalize the details?

Best regards, [Your Name]

Objection Handling

Objection: “Finance costs increase significantly with longer terms—we can’t absorb that.”

Response: “I understand—working capital costs are real. What if we structured this with an early payment option? We’d move to Net 60 as the standard term, but if you need faster cash, we’ll pay within 15 days for a 1.5% discount. That gives you the option to monetize speed when you need it while giving us the flexibility when our cash is tight. Would that offset your finance costs enough to make it workable?”

Objection: “Energy and pulp costs are too volatile right now—we need faster cash to hedge that risk.”

Response: “That’s fair—commodity volatility is real. What if we split the difference and moved to Net 37 instead of Net 45? That’s a smaller extension and might ease the volatility concern. Alternatively, we could link payment terms to your input costs: if pulp prices (based on [public index]) rise more than 10% above [baseline] for 60 days, terms automatically revert to Net 30 until costs stabilize. Would either of those structures help?”

Objection: “Our exporter partner charges us fees for financing extended terms—we’d have to pass those through to you.”

Response: “I appreciate the transparency. Let’s look at the numbers. If the financing fee is 1–2% for the extra 15 days, that’s still less than the cost of us bridging the gap with overdraft facilities. Could we split the financing cost? For example, we absorb half of the fee in exchange for the extended terms, and you absorb the other half. That way, we’re both contributing to make the structure work.”

Objection: “We’re already at our risk limit with you.”

Response: “Thank you for being direct about that. Would a combination of staggered deliveries and tiered credit limits work better? For example, we could tie a higher credit limit to our on-time payment performance—if we maintain 95% on-time for two quarters, the limit increases by 20%. That gives you objective criteria to manage risk while giving us room to grow.”

Objection: “If policy prevents extending terms now, can we at least document the proposal?”

Response: “Absolutely. Let’s document the proposed structure in writing and set a firm review date in three months. That gives your team time to evaluate it during the next budget cycle, and we both have clarity on what we’re working toward.”

Objection: “If your concern is input cost volatility, we’re ready to discuss pass-through clauses.”

Response: “We appreciate that willingness. If we can structure a pass-through clause that protects your cost risk for major shifts in pulp or freight—say, adjustments trigger when costs move more than 10% for 60+ days—would that make a modest term extension more feasible? That way, you’re protected on the cost side while we gain some working capital relief.”

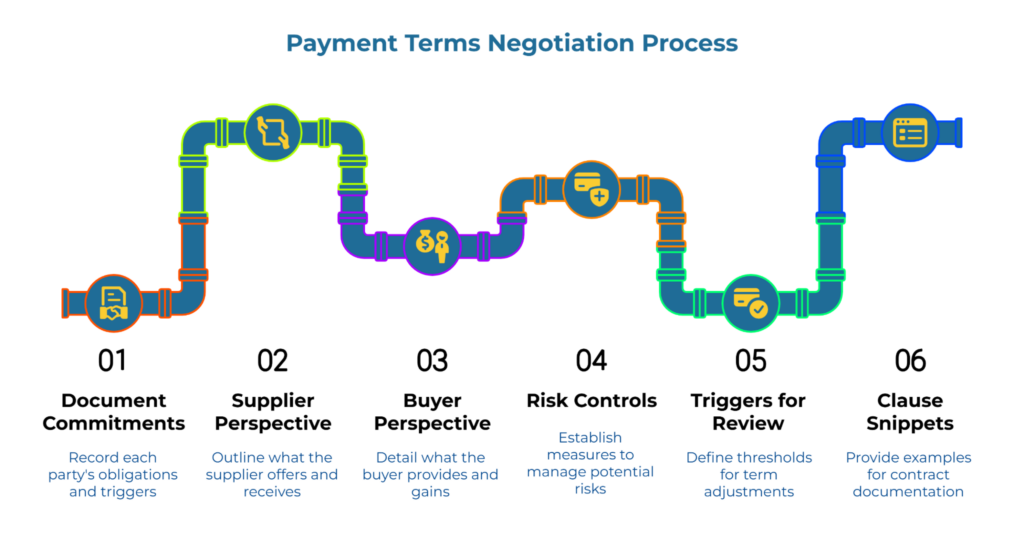

Design the Trade: Term + Evidence + Trigger

Before finalizing any term change, document what each side is committing and what triggers a review or reversion. The worksheet below structures that negotiation.

What You’ll Give / What You’ll Get

Supplier Perspective:

- Give: Extended terms (e.g., Net 30 to Net 45), flexibility during seasonal peaks

- Get: Volume commitment (e.g., 20 tons/month minimum), forecast visibility (90-day rolling), reference contacts from buyer’s quality or operations team

Buyer Perspective:

- Give: Volume commitment, forecast sharing, faster payment history, relationship references

- Get: Extended terms, pricing stability, priority delivery during high-demand periods

Risk Controls

Both parties should document how the new structure manages downside risk:

Credit Limit: Set a maximum open balance (e.g., “Buyer’s outstanding invoices will not exceed $50,000 at any time”)

Letter of Credit Fallback: Specify conditions that trigger reverting to LC (e.g., “If Buyer’s on-time payment rate drops below 80% for two consecutive months, Seller may require LC for future orders”)

Document Set: Define which documents are required for payment release (e.g., “Payment is due Net 30 from the date Buyer receives: original Bill of Lading, commercial invoice, packing list, and Certificate of Analysis”)

Triggers for Review or Reversion

Define objective thresholds that prompt a term review or automatic change:

On-Time Payment Rate: “If Buyer maintains ≥95% on-time payment for six months, terms automatically extend to Net 60. If on-time rate drops below 85%, terms revert to Net 30.”

Dispute Rate: “If disputed invoices exceed 5% of total invoices in any quarter, both parties will review quality specifications and inspection procedures within 30 days.”

Volume Threshold: “If Buyer’s monthly orders drop below [minimum] tons for two consecutive months, Seller may adjust payment terms or pricing with 30 days’ written notice.”

Clause Snippets for Documentation

Illustrative examples only—these must be reviewed under company policy and local law before use.

Review Window: “Both parties will review payment terms, pricing, and volume commitments quarterly in [month/month/month/month]. Either party may propose adjustments with 30 days’ written notice. If no adjustment is proposed, terms continue unchanged.”

Change Control: “Any change to payment terms, pricing, or minimum volumes requires written approval from both parties. Verbal agreements do not modify this contract. Changes take effect on the first day of the month following written approval.”

Reversion Rule: “If Buyer’s on-time payment rate drops below 85% for two consecutive months, terms automatically revert to Net 30 until on-time performance exceeds 90% for 60 consecutive days. Seller will provide written notice of reversion at least 15 days before the effective date.”

For more context on structuring change control and review windows, see change control in paper contracts.

Mini-Examples (Illustrative Only)

These examples are simplified, illustrative scenarios to show directionally how small changes can matter. Real numbers will depend on each company’s situation and should not be treated as guidance or recommendations.

Example 1: +15 Days on a 40-Day Cash Cycle

Scenario: A buyer currently operates on a 40-day cash conversion cycle: 10 days inventory + 30 days receivables. Supplier payment terms are Net 30.

Current State: Cash gap = (10 + 30) – 30 = 10 days funded by working capital.

Proposed Change: Buyer requests Net 45 terms.

New State: Cash gap = (10 + 30) – 45 = -5 days (supplier financing the gap).

Impact: The 15-day extension eliminates the buyer’s cash gap and creates a 5-day buffer. The supplier now waits 45 days for payment instead of 30.

Example 2: 2/10 Net 30 Effect on Days Sales Outstanding (DSO)

Scenario: A supplier offers 2/10 Net 30 terms. Historically, 30% of buyers pay within 10 days to capture the discount, and 70% pay at day 28–30.

Calculation: Weighted average collection = (0.30 × 10 days) + (0.70 × 29 days) = 3 + 20.3 = 23.3 days

Impact vs. Straight Net 30: DSO improves by approximately 6–7 days (from ~29–30 days to ~23 days). The supplier accelerates cash flow from roughly one-third of buyers while maintaining flexibility for others.

Cost: The 2% discount on 30% of volume = 0.6% effective discount rate across all sales.

Example 3: Advance Reduction Over Time

Scenario: A supplier requires 25% advance on first orders with a new buyer. After three successful orders, advance drops to 10%. After three more clean orders, advance is eliminated entirely, and buyer moves to Net 30 open account.

Order 1–3: Buyer pays 25% advance + 75% on delivery. Supplier risk exposure per order = 75% of order value (until delivery).

Order 4–6: Buyer pays 10% advance + 90% on delivery. Supplier risk exposure = 90% of order value.

Order 7+: Buyer pays Net 30 open account. Supplier risk exposure = 100% of order value + 30 days of credit.

Impact: The staged reduction lets both parties build trust incrementally. The buyer demonstrates payment reliability, and the supplier extends credit gradually rather than all at once.

Finalize & Document

Once you’ve agreed on terms, document the arrangement clearly to prevent future disputes.

Redline Tips

If you’re modifying an existing contract, use redline (track changes) mode to show exactly what’s changing. Highlight:

- Old payment terms vs. new payment terms (e.g., “Net 30” strikethrough, “Net 45” added)

- New volume commitments or minimum order quantities

- New review dates or trigger clauses

Both parties should initial each redlined change and sign a cover page that references the redlined document.

Who Signs

Clarify signing authority:

- Supplier side: Verify Delegation of Authority (DOA). Often requires Credit Manager or CFO signature if total exposure exceeds $50k

- Buyer side: Verify DOA. Procurement managers often have a signature cap; term changes affecting working capital usually require Finance Director or Controller approval

Large term changes (e.g., moving from advance to open account, or extending terms beyond 60 days) often require CFO or controller approval. Check internal policies before finalizing.

Attach Evidence Pack

Include supporting documents that justify the new terms:

- Payment history report (e.g., “Buyer’s last 12 invoices: 11 paid on time, 1 paid 2 days late”)

- Volume forecast (e.g., “Projected monthly orders: [month 1] 15 tons, [month 2] 18 tons…”)

- Quality performance summary (e.g., “6 deliveries, zero rejected lots, 1 minor packaging issue resolved”)

Evidence makes the term change defensible to internal stakeholders (finance, credit, operations) and creates accountability for maintaining performance.

Set Quarterly Business Review (QBR) Cadence

Schedule regular check-ins to review:

- Payment performance (on-time rate, dispute rate)

- Volume vs. commitment

- Quality trends

- Market conditions (commodity prices, freight rates, FX) that might warrant term adjustments

Typical QBR cadence: Every 3 months for new relationships, every 6 months for established relationships.

Define Rollback Triggers

Document what happens if performance degrades:

- “If on-time payment rate drops below 85% for 2 consecutive months, terms revert to Net 30 with 15 days’ written notice.”

- “If monthly volume drops below [minimum] tons for 2 consecutive months, Supplier may adjust terms or pricing with 30 days’ notice.”

Clear rollback clauses prevent arguments later. Both parties know the performance threshold and the consequences if it’s not met.

Copy-Ready Appendix

The following scripts are ready to copy and adapt for your specific situation. Adjust names, numbers, and timelines to fit your context.

6 Email Templates

- Supplier: First Order Advance Request (see Scripts for Suppliers section)

- Supplier: Repeat Buyer Terms Change (see Scripts for Suppliers section)

- Supplier: Pilot-to-Scale-Up Structure (see Scripts for Suppliers section)

- Buyer: New Supplier Introduction (see Scripts for Buyers section)

- Buyer: Good-History Extension Request (see Scripts for Buyers section)

- Buyer: Seasonal Extension Request (see Scripts for Buyers section)

8 Call Openers

Suppliers:

- Net 45 to Net 30 request (see Scripts for Suppliers section)

- Swap price hold for early payment discount (see Scripts for Suppliers section)

- Partial advance on first orders (see Scripts for Suppliers section)

- Cap exposure with credit limit (see Scripts for Suppliers section)

Buyers:

- Net 45 request after track record (see Scripts for Buyers section)

- 2/10 Net 30 structure request (see Scripts for Buyers section)

- Staggered milestone payments (see Scripts for Buyers section)

- Request open account after trial period (see Scripts for Buyers section)

10 Objection Replies

Suppliers:

- “We can’t prepay” → Deposit workaround or smaller shipments (see Objection Handling section)

- “Policy caps at Net 30” → Volume-for-pricing trade (see Objection Handling section)

- “Year-end freeze” → Document now, effective later (see Objection Handling section)

- “Advances not possible” → Limit shipment sizes and build history

- “Credit insurer is cautious” → Lower limits with gradual increases

Buyers:

- “Finance costs increase with longer terms” → Early payment option (see Objection Handling section)

- “Energy/pulp volatility” → Split the difference or index-linked reversion (see Objection Handling section)

- “Exporter financing fees” → Split the fee (see Objection Handling section)

- “Already at risk limit” → Tiered limits tied to performance (see Objection Handling section)

- “Policy prevents extensions now” → Document proposal and set review date

6 Clause Snippets

Illustrative examples only—must be reviewed under company policy and local law.

Suppliers:

- Early payment discount (see Plain-Language Clauses section)

- Evidence-based release (see Plain-Language Clauses section)

- Credit limit with automatic review (see Plain-Language Clauses section)

Buyers:

- Review window (see Design the Trade section)

- Change control (see Design the Trade section)

- Reversion rule (see Design the Trade section)

Now that you’ve identified a term structure that fits your situation, the next step is applying it with real trading partners. If you’re a buyer ready to test your term design with verified suppliers, explore options on the supplier directory. If you’re a supplier looking to connect with active buyers, you can contact buyers directly or join the platform to access the full buyer network.

For additional guidance on structuring contracts and managing cost volatility, visit PaperIndex Academy, which offers resources on topics like kraft paper cost drivers and budget bands for kraft paper.

Educational note: This guide is for professional buyers and suppliers in the kraft paper supply chain. It is informational, not legal or financial advice. Any numbers are illustrative only.

Disclaimer: This guide is for educational purposes. Nothing here is legal or financial advice. Examples are illustrative; not legal or financial advice. Route final clauses through company policy or counsel before implementation.

Our Editorial Process

Our expert team uses AI tools to help organize and structure our initial drafts. Every piece is then extensively rewritten, fact-checked, and enriched with first-hand insights and experiences by expert humans on our Insights Team to ensure accuracy and clarity.

About the PaperIndex Insights Team

The PaperIndex Insights Team is our dedicated engine for synthesizing complex topics into clear, helpful guides. While our content is thoroughly reviewed for clarity and accuracy, it is for informational purposes and should not replace professional advice.