📌 Key Takeaways

Technical vetting before RFQs eliminates quote-only suppliers and prevents costly quality failures after contract award.

- Evidence Beats Promises: Suppliers must prove capability through method-named test reports, conditioning documentation, and traceability—not glossy brochures or verbal assurances.

- Screen First, Quote Later: A 10–15 minute pre-RFQ checklist filtering suppliers on testing discipline, acceptance criteria, and change control prevents wasted effort on vendors who cannot hold specifications at volume.

- Comparability Requires Standards: Test results become meaningful only when suppliers name methods (TAPPI T 811, ISO 3037), document conditioning parameters (23°C/50% RH), and apply explicit pass/fail thresholds.

- Stage Gates Protect Resources: Sequential checkpoints—initial screen, evidence pack request, scoring rubric, then RFQ—ensure only technically competent suppliers receive detailed specifications and negotiation time.

- Capability Gaps Persist: Vendors unable to describe process controls, sampling plans, or CAPA workflows rarely improve through contracts; the competence either exists before quoting or it does not.

Proof before paperwork = fewer line stoppages and disputes.

Procurement managers sourcing corrugated packaging will gain a repeatable qualification framework here, preparing them for the technical screening checklist and evidence evaluation guide that follows.

When a new corrugated box supplier is needed fast, time disappears in the wrong places: long RFQs, glossy samples, reassuring promises—followed by preventable surprises once volume starts. The fastest path is usually not “more quoting,” but proof of capability before price discussions begin. No drama. Just evidence.

A practical rule that often holds: suppliers who cannot name test methods and conditioning—and explain how they control variability—are rarely “fixed” later by an RFQ.

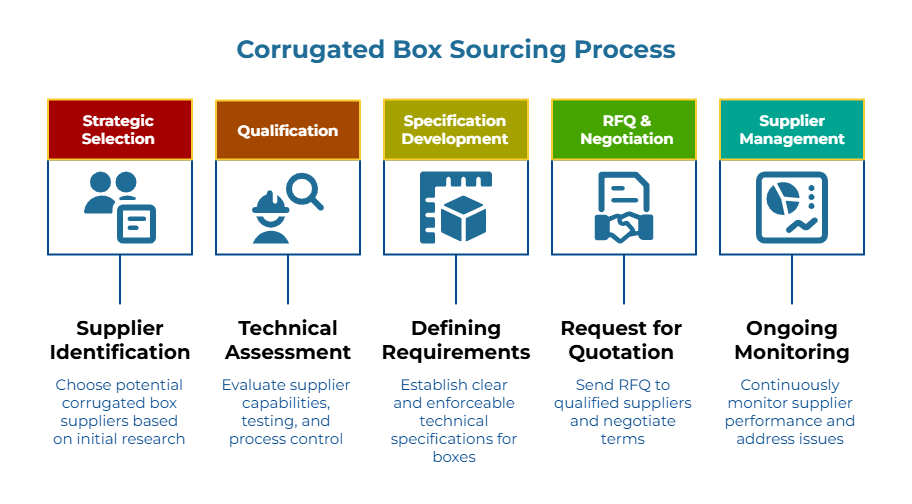

Corrugated box sourcing is the strategic process of selecting, qualifying, and managing packaging suppliers to ensure consistent quality, cost predictability, and operational reliability across production and distribution. It involves balancing performance requirements (strength, print, machinability), material variables (liner grades, flute profiles, moisture sensitivity), and supplier capability (testing, process control, lead-time discipline). Effective corrugated sourcing goes beyond unit price by building enforceable specifications, verifying claims through comparable test evidence, and using structured qualification to reduce downstream failures like line stoppages, damage claims, and vendor disputes.

Execute a 10-to-15-minute technical screen to filter out ‘quote-only’ vendors before investing in detailed specifications.

What “Technical Competence” Means in Corrugated Supply

Technical competence is not about impressive equipment or polished presentations. It is the demonstrable ability to deliver consistent, specification-conforming products at scale—and to prove it with test-method-named, comparable evidence. Quiet consistency.

Three capabilities define a technically competent supplier:

Scalable Specification Adherence. Consistently manufacture boxes meeting ECT, burst, and caliper requirements through documented process control (monitored machine settings and recorded variability).

Measure and verify objectively. Test production using named methods—not just “meets standards” claims—condition samples properly before testing, and apply explicit acceptance criteria with pass/fail thresholds. Without method names and conditioning parameters, results from different suppliers cannot be meaningfully compared. Enforceable.

Troubleshoot and improve systematically. When problems occur, follow a structured approach: controlled trials before production changes, root cause analysis for defects, and documented corrective actions (CAPA) that prevent recurrence.A vendor struggling to describe these areas in documentable terms is unlikely to control variability at volume. For a broader framework, see from specs to sourcing: a strategic roadmap for resilient procurement.

The most common sourcing mistake is treating qualification as a single event after selecting a vendor based on price. A resilient approach uses stage gates—sequential checkpoints that filter suppliers before significant resources are invested.

Step 1: Initial screen (10–15 minutes). Run through the checklist below via email or a short call. Look for suppliers who speak specifically about methods, processes, and documentation. Vague responses at this stage typically predict vague performance later.

Step 2: Evidence pack request. For passing suppliers, request a sample certificate of analysis (COA), test report with method names, and traceability example. Keep the request focused—this is verification, not an audit.

Step 3: Score and gate. Apply the scoring rubric to decide who earns an RFQ. Suppliers who cannot provide basic evidence rarely improve with further discussion. The Trust Protocol framework provides additional verification structure.

Step 4: RFQ to qualified vendors only. The RFQ now goes to suppliers who have demonstrated basic technical capability, reducing downstream risk of quality disputes and operational disruption.

Vendor Technical Vetting Checklist: 10 Questions

Each question includes what you are trying to learn, good answer indicators, red flags, and proof to request.

1. What tests do you run in-house versus outsource, and which methods?

Learn: Internal testing capability and method naming.

Good: Specific method codes cited (e.g., TAPPI T 839 for production, TAPPI T 811 for referee, or ISO 3037).

Red flag: “We test everything” without specifics.

Proof: Test report showing method codes.

2. How do you condition samples before testing?

Learn: Understanding that paper properties change with humidity.

Good: Reference to TAPPI T 402 or ASTM D4332 conditioning (23°C/50% RH).

Red flag: “We test right off the line.”

Proof: COA showing conditioning parameters.

3. What acceptance criteria do you use, and where documented?

Learn: Whether explicit pass/fail thresholds exist.

Good: Specific numeric thresholds referenced.

Red flag: “We aim for the target.”

Proof: Quality plan with acceptance criteria.

4. What lab equipment do you use and how often calibrated?

Learn: Equipment maintenance discipline.

Good: Equipment types named, calibration frequency stated.

Red flag: “We calibrate when readings seem off.”

Proof: Calibration certificate excerpt.

5. How do you sample production for testing?

Learn: Systematic versus ad hoc sampling.

Good: Frequency tied to production runs, specific sample positions.

Red flag: “We grab a sample when we can.”

Proof: Sampling plan or SPC chart.

6. What process variables do you control and record?

Learn: Input control, not just output measurement.

Good: Variables named (liner tension, glue rate, heat settings).

Red flag: “Operators know what to do.”

Proof: Run sheet or process control checklist.

7. How do you handle traceability on COAs and delivery documents?

Learn: Whether problems can be traced to source.

Good: Unique lot codes linking finished goods to mill roll IDs and corrugator run data.

Red flag: Date stamps only, no lot identification.

Proof: COA and packing slip showing traceability fields.

8. What is your change-control process?

Learn: Customer notification when changes occur.

Good: Documented procedure with customer notification requirement.

Red flag: “We switch grades based on availability.”

Proof: Change-control procedure summary.

9. How do you run trials and what data is captured?

Learn: Structured validation before full production.

Good: Defined stages (sample → line trial → run-at-rate).

Red flag: “We just run it and see.”

Proof: Trial report excerpt.

10. What is your nonconformance and CAPA workflow?

Learn: Systematic problem prevention.

Good: Documented CAPA with root cause analysis and verification.

Red flag: “We handle problems as they come.”

Proof: CAPA procedure summary.

For more on building compliance checklists, see structuring your compliance audit checklist for packaging suppliers. Worth bookmarking.

What to Request in the Evidence Pack

After passing the initial screen, request focused documentation to verify claims. This is not a full audit—keep the request tight and specific.

Copy/paste template (adapt as needed to the product and risk profile):

Sample COA or test report. Look for method names (not just “ECT test” but the actual method code), conditioning parameters stated, acceptance criteria or specification limits shown, and lot/run ID for traceability.

Sampling plan summary. Frequency of testing, where samples are taken (position on sheet, point in run), and how results are recorded.

Traceability example. Sample COA and packing slip that can be cross-referenced—same lot code, date, and product ID appearing on both documents.

Calibration certificate excerpt. Instrument identified, calibration date and next due date, calibration traceability documented.

The goal is comparability. When evidence from multiple suppliers is reviewed side by side, clear patterns emerge: Who names methods consistently? Who documents conditioning? Who can trace finished goods back to raw materials? These distinctions matter far more than glossy capability brochures.

When conditioning discipline is discussed, anchoring to recognized references can help align expectations across organizations, such as ASTM D4332 or TAPPI T 402. Context still matters.

Utilize ISTA protocols to standardize test conditions and verify distribution performance claims.

Scoring Rubric: Who Earns an RFQ

Every supplier needs to clear minimum gates before significant RFQ effort is invested.

| Criterion | Pass | Caution | Fail |

| Testing capability | In-house; methods named | Some outsourcing | Cannot name methods |

| Conditioning | Parameters on COA | Mentioned, not documented | No awareness |

| Acceptance criteria | Explicit thresholds | Targets only | “We meet standards” |

| Traceability | Lot IDs link materials | Incomplete linkage | No traceability |

| Trial discipline | Defined stages; data captured | Informal trials | “Run it and see” |

Minimum gates: Pass on testing, conditioning, acceptance criteria, and traceability.

Fail-fast: Refuses COA format, cannot name methods, no traceability.

Trial path: Promising suppliers with gaps may qualify through small trial orders with explicit requirements.

Red Flags That Predict Quality Failures

Watch for these patterns: vague standards references without method names (e.g., ‘We meet ASTM standards’ versus ‘We test per TAPPI T 839‘ or ‘Fabricate to ASTM D5118‘); single-point results missing conditioning and lot context; reluctance to share COA format; undisclosed grade changes without notification; no documented corrective action workflow; and “we meet standards” offered without specifics about which standards or how compliance is verified.

Frequently Asked Questions

What tests should a corrugated supplier run in-house?

Capabilities vary widely by supplier size and quality system. In many operations, the key is not whether everything is internal, but whether the supplier can (a) name methods, (b) control conditioning, and (c) document acceptance criteria, with credible calibration discipline. Some tests may be outsourced appropriately, as long as the outsourcing model is transparent and evidence is consistent. Context-dependent.

How can test results be made comparable across suppliers?

Standardize the requested evidence fields: method naming, conditioning parameters, and explicit acceptance criteria. Conditioning references like TAPPI T 402 or ASTM D4332 can support the discussion, but the most important part is disciplined documentation and repeatability.

ISO 9001 as a Baseline?

ISO 9001 is a useful baseline indicator of a quality management system, but it is not a substitute for product-specific capability evidence. Many teams treat ISO 9001 as supportive context, then rely on method-named evidence packs and trial discipline for technical proof.

What is the fastest way to shortlist without full trials?

Run the stage gate: quick screen, then request a small evidence pack with method naming, conditioning, and acceptance criteria, plus traceability and change control. If evidence is strong, proceed to an RFQ; if evidence is partial, a limited controlled trial can be used before volume decisions.

Should transit testing capability factor into selection?

For applications where distribution performance matters, transit testing provides valuable assurance. ISTA test procedures offer standardized protocols for simulating distribution hazards. Not every supplier needs in-house transit testing, but the ability to arrange ISTA-compliant testing on request indicates a supplier who understands the full performance envelope.

From Price to Proof

Vendors who cannot name methods, show conditioning documentation, or demonstrate variability control are rarely fixable later with a detailed RFQ. The capability gap exists before the quote and persists after the contract. For perspective on why price-first selection increases total cost, see stop buying on price: why ‘cheap’ boxes cost more in the long run.

By running a short technical screen before specifications and negotiations, procurement builds a shortlist of suppliers who prove capability through evidence—not just claim it. That is the foundation of resilient corrugated box sourcing.

Ready to build a qualified shortlist? Explore verified suppliers on PaperIndex.

Disclaimer:

This article is for educational purposes. Verification decisions should follow your organization’s due diligence processes.

Our Editorial Process:

Our expert team uses AI tools to help organize and structure our initial drafts. Every piece is then extensively rewritten, fact-checked, and enriched with first-hand insights and experiences by expert humans on our Insights Team to ensure accuracy and clarity.

About the PaperIndex Insights Team:

The PaperIndex Insights Team is our dedicated engine for synthesizing complex topics into clear, helpful guides. While our content is thoroughly reviewed for clarity and accuracy, it is for informational purposes and should not replace professional advice.