📌 Key Takeaways

Payment terms shape working capital needs as powerfully as unit price, making them a negotiable lever for controlling cash flow in paper bag procurement.

- Map Your Cash Gap First: Calculate Customer Payment Days + Inventory Days − Supplier Payment Days to identify exactly where cash is stuck.

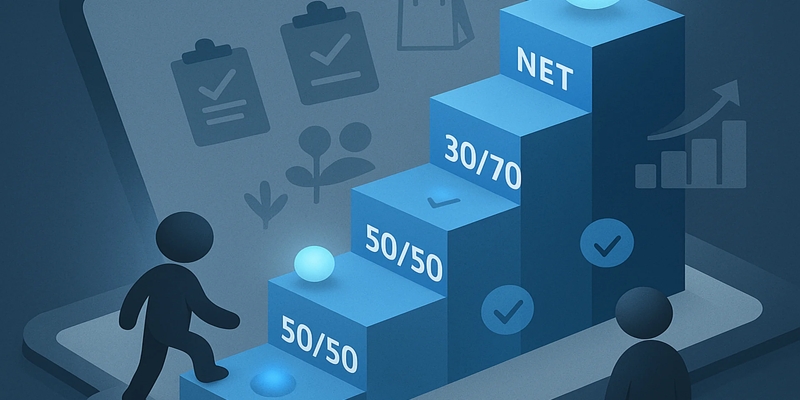

- Request Term Ladders, Not Term Flips: Staged progressions from 50/50 deposits to Net 30 over proven orders reduce supplier anxiety while building your breathing room.

- Negotiate the Trigger Point: Net 30 from invoice date, shipment date, or delivery date creates vastly different cash timing—clarify and negotiate this detail.

- Use Volume Commitments as Currency: Modest monthly volume pledges or rolling forecasts justify better payment terms by reducing supplier forecasting uncertainty.

- Reliability Becomes Leverage: Suppliers extend credit to buyers who demonstrate consistent on-time payments, clear documentation, and predictable ordering patterns.

Better terms come from becoming the lowest-risk small buyer, not the loudest negotiator.

Small and mid-sized paper bag buyers managing tight working capital will gain specific negotiation scripts and decision frameworks here, preparing them for the term-by-term analysis and supplier conversation templates that follow.

Cash leaves your account the moment you order paper bags. Customer payments trickle in weeks, sometimes months, later. Your inventory sits in between, tying up money that could be keeping your business running smoothly.

This is the cash gap that squeezes small and mid-sized paper bag buyers every single day. Payment terms design—aligning when you pay suppliers with when customers pay you—is often the fastest way to shrink that gap. The good news? Payment terms are rarely set in stone, specifically when dealing with wholesalers or converters. Understanding how to source small lots when cash flow is tight provides additional context for these negotiations. While large commodity mills may be rigid, mid-sized suppliers are often open to negotiating terms with smaller buyers who can demonstrate a history of reliability. When sourcing from international paper bags suppliers, building this track record becomes even more critical.

This guide will show you why payment terms deserve as much attention as price negotiations, give you specific levers to discuss with suppliers, and provide ready-to-adapt scripts that protect your cash flow without damaging the relationships you depend on. By the end, you will have a clear framework for approaching these conversations with confidence.

Why Payment Terms Matter as Much as Price for Paper Bags

Most buyers fixate on unit price when negotiating with paper bag suppliers. That focus is understandable but incomplete. The timing of when cash moves out versus when it comes back shapes your financial health just as much as what you pay per bag or per ton.

Consider this simple illustration. Your paper bag supplier requires full payment on order. Your customers pay you 60 days after delivery. Your inventory sits in the warehouse for 15 days on average. That means your cash is tied up for roughly 75 days before it starts returning. Now imagine you negotiate Net 30 terms with your supplier instead of advance payment. Suddenly, you have reclaimed 30 days of breathing room, potentially cutting your working capital needs in half.

This timing difference creates your working capital strain from payment terms. It determines how much overdraft you need, how much financing costs eat into your margins, and whether you can take advantage of opportunities when they arise. Net 30 instead of advance payment can reduce peak overdraft usage. A smaller deposit keeps cash available for payroll and logistics. Milestone payments reduce working capital strain during long lead times.

Know Your Playing Field: Common Paper Bag Payment Terms and Incoterms

Before entering any negotiation, you need to understand the landscape. Payment terms in paper bag trade generally fall into a few common structures, each with different implications for when your cash moves.

Common Payment Terms Structures

Advance / 100% Prepayment: Cash out before production starts. This creates the longest cash gap for buyers but eliminates supplier risk.

Deposit + Balance: Common splits include 30/70 or 50/50, with the balance due before shipment or against documents. This balances risk between both parties.

Cash on Delivery (COD): Pay at delivery. Often used domestically where transit times are short.

Net Terms: Payment due within a specified number of days. Net 30 typically requires payment 30 calendar days from the invoice date, though international buyers should explicitly clarify this trigger point (e.g., ‘from invoice’ vs. ‘from receipt of goods’) in the contract to avoid disputes arising from differing regional commercial codes. Other common variations include Net 7, Net 15, Net 45, and Net 60.

Early Payment Discounts: Structures like 2/10 Net 30 offer a 2% discount if paid within 10 days; otherwise the full amount is due in 30 days. This gives buyers a choice between preserving cash or capturing a discount.

Letter of Credit (LC): A bank-supported payment structure used in some cross-border transactions. While more costly, it reduces counterparty risk for both buyer and supplier by having a bank guarantee payment upon presentation of specified documents.

Understanding Incoterms and Their Impact on Cash Timing

Incoterms define responsibilities for delivery, risk transfer, and cost allocation in international trade. They do not set price or payment terms directly, but they strongly influence when costs hit your account and when risk transfers, which affects both negotiation leverage and cash timing.

If shipping, insurance, duties, or unloading costs shift between buyer and supplier under different Incoterms, the timing of those cash outflows shifts too. EXW (Ex Works) places logistics responsibility entirely on you as the buyer, meaning you pay freight and insurance separately and often earlier. CIF (Cost, Insurance and Freight) means the supplier handles freight and insurance to your port, bundling more costs upfront but delaying some of your cash outflow. Understanding Incoterms for kraft paper buyers helps clarify these cost allocations. If risk transfers earlier under certain terms, suppliers may insist on earlier payment or tighter documentation conditions.

These details affect not just price but when and how cash flows through your business.

Illustrative Cash Gap Comparison

These numbers are illustrative, but the pattern holds. Different term structures create dramatically different cash gaps.

| Scenario | Cash-Out Timing | Cash-In Timing (Example) | Cash Gap (Days) | Risk Notes |

| 100% advance + CIF | Before shipment | 60 days post-delivery | 90+ days | Buyer carries full risk and longest cash gap |

| 30% advance, 70% on Bill of Lading + FOB | Split at order and shipment | 60 days post-delivery | 60-75 days | Balanced risk; supplier has skin in the game |

| Net 30 on dispatch + EXW | 30 days after dispatch | 60 days post-delivery | 45-50 days | Shorter gap but buyer handles logistics risk |

Map Your Cash Gap Before You Negotiate

Walking into a negotiation without knowing your own numbers is like navigating without a map. Before you ask for better terms, you need to understand where your cash is actually stuck.

The basic formula is straightforward:

Cash Gap = Customer Payment Days + Inventory Days − Supplier Payment Days

A longer gap means more working capital tied up. A shorter gap means cash returns faster. Your goal is to shrink this gap through better alignment between when you pay suppliers and when customers pay you.

Start with a quick inventory of your current situation. List your top three to five paper bag suppliers and their current payment terms. Note your major customer segments and how long they typically take to pay. Estimate how many days your key paper bag SKUs sit in inventory before being used or sold. For insight into inventory management challenges, consider how carrying costs accumulate during this period.

This exercise often reveals surprises. Many business owners discover that a single supplier or customer segment is responsible for most of their cash strain. For a deeper dive into mapping your specific situation, the simple guide to seeing and fixing your cash flow gap walks through the process step by step.

The Negotiation Levers: What You Can Actually Ask For

Payment terms are more flexible than most small buyers realize. Several elements can move, and framing requests in ways that make sense for both sides opens pathways that seemed closed at first glance.

Key Terms You Can Negotiate with Paper Bag Suppliers

1. Re-structure Deposits (Risk-Balanced)

Instead of asking to remove the deposit entirely, propose structures that reduce supplier risk while improving your cash timing:

- Move from 50% deposit to 30% deposit

- Split deposits across milestones: 30% at purchase order, 20% at production start, 50% after shipment

- Offer deposit only for the first order, then review terms after demonstrating on-time payments

2. Shift the Trigger Point for Net Terms

The devil is in the details. Net 30 can mean very different things depending on what triggers the countdown:

- Net 30 from invoice date

- Net 30 from shipment date

- Net 30 from delivery date

These differences matter significantly when transit time is long. Clarifying and negotiating the trigger point can add days or weeks of breathing room.

3. Structure of Terms: Milestone Payments

Pure advance payments are not the only option. Milestone-based payments tied to production completion, quality inspection clearance, or shipment can balance risk for both parties. If production takes weeks, milestone payments are often more reasonable than a large upfront deposit.

4. Request a Term “Path,” Not a Term “Flip”

Suppliers often prefer a ladder approach rather than an immediate shift to favorable terms. A typical progression might look like:

- Order 1: 50% deposit / 50% balance

- Orders 2-3 (with on-time payment): 30% deposit / 70% balance

- Orders 4+: Net 15 from shipment

- After 6 months of reliable payment: Net 30 with an agreed credit limit

This staged approach reduces supplier anxiety while giving you a clear path to better terms.

5. Discount Versus Days Trade-Off

Some suppliers offer early-payment discounts like 2/10 Net 30, meaning a 2% discount if paid within 10 days. You might propose the reverse: accepting a slightly higher price or forgoing a discount in exchange for extended payment days. Run the math on the ‘cost of capital’: while a 2% discount represents a significant financial gain (roughly 36% annualized return), you may still choose to forgo it if preserving immediate cash liquidity is critical to avoiding overdrafts or stockouts.

6. Volume and Commitment Levers

Committing to a minimum monthly volume, even a modest one, can justify better terms. Suppliers value predictability and may extend credit to buyers who reduce their forecasting uncertainty. Offering a rolling forecast or agreeing to a reorder cadence demonstrates seriousness.

7. Risk-Sharing Arrangements

Propose partial payments tied to specific milestones, such as a portion released after quality inspection passes or after a successful trial order. This reduces supplier concerns about extending credit to newer customers while giving you more control over cash timing.

The goal is not to win against suppliers. The goal is to design terms that keep both parties solvent and predictable. Suppliers who feel squeezed or disrespected will find ways to protect themselves, often through less visible channels like slower service or deprioritized allocation during shortages.

For buyers who feel they lack leverage due to smaller volumes, the guide on limited negotiating power with kraft paper suppliers offers strategies for building influence over time.

Negotiation Scripts You Can Adapt

Knowing what to ask for is only half the challenge. Knowing how to ask matters just as much. These scripts are templates that you should adapt to your specific context, relationship, and local business norms.

Script 1: Data + Partnership Approach (Email to New Supplier)

Subject: Payment terms alignment for upcoming paper bag orders

Hi [Name],

Thanks for supporting recent orders. To keep reorder volume consistent, terms need to match the cash cycle on the buyer side. Current terms create a cash gap that spikes working capital strain during transit and stocking.

Request: Move to Net 30 from invoice date with a starting credit limit of [amount].

Support: On-time payment history on [order dates] and a forward forecast for the next [X] weeks.

If Net 30 is not possible yet, a workable alternative is 30% deposit with 70% on delivery, or split deposit milestones.

Open to a 60-day review to adjust based on payment performance.

Thanks,

[Your Name]

[Your Role] | [Your Company]

Script 2: First-Time Terms Discussion with a New Supplier (Phone/Video Call)

“We are excited to work with you and see potential for a long-term relationship. Before we finalize, I wanted to discuss payment terms. Our business operates with customer payment cycles of around 60 days, so full advance payment creates significant cash flow pressure on our end. Would you be open to a structure like 30% advance with the balance due Net 15 after shipment? We are committed to clear communication and reliable payments, and we are happy to start with a smaller trial order to demonstrate that.”

Script 3: Requesting Better Terms from an Existing Supplier

“We have been working together for [X months], and I hope you have seen that we pay consistently and on time. Given our track record, I would like to discuss adjusting our payment terms. Currently we are at [current terms]. Would you consider extending to Net 30, or shifting 20% of the payment to post-delivery? We value this relationship and want to continue growing our orders with you.”

Script 4: Give-Get Framing (When Initial Request Meets Resistance)

“Terms are the bridge between inventory and cash coming back in. To keep orders steady, terms need to be designed around that cash gap. If moving to Net 30 is difficult right now, what would make it easier: a forecast, a reorder commitment, or a staged-term path over the next few orders?”

Script 5: Responding When the Supplier Says No

“I understand that extending full Net 30 may not work right now. Would you be open to a smaller step, perhaps trialing Net 15 for a subset of our orders? Or we could explore a structure where improved terms kick in after we hit a certain order volume. I am looking for something that works for both of us.”

Script 6: When Supplier Cites Policy or Asks for Credit Proof

“Fair point. References can be provided, and a staged increase is acceptable. Start with Net 15 and a small credit limit, and step up after three on-time payments. That keeps risk controlled on both sides.”

The Decision Path After Your Initial Request

When you ask for better terms, the conversation typically branches. If the supplier agrees, confirm expectations clearly in writing and document the new arrangement. If they decline, do not walk away immediately. Offer trade-offs such as volume commitments, early-payment behavior on a portion of orders, or phased improvements over time. Sometimes the path forward is incremental: a small improvement now that opens the door to better terms after you have demonstrated reliability.

For additional scripts covering different scenarios, the PaperIndex Academy’s guide on scripts you can use to ask for better terms offers more variations.

Choosing the Right Negotiation Approach: A Decision Framework

Not every negotiation should follow the same path. Use this decision tree to systematically choose your approach:

Step 1: Is this a new supplier relationship with no payment history?

- Yes → Ask for a trial structure: smaller deposit, milestone payments, and a review after 1-2 orders. Proceed to Step 2 after establishing a track record.

- No → Proceed to Step 2.

Step 2: Is there a record of on-time payments with this supplier?

- No → Fix reliability first. Pay on time, communicate early about any issues, then renegotiate from a position of demonstrated trustworthiness.

- Yes → Proceed to Step 3.

Step 3: Is the cash gap driven by deposit size or by due date timing?

- Deposit-driven → Negotiate deposit reduction or split milestones.

- Timing-driven → Negotiate Net terms or change the trigger point (invoice vs. shipment vs. delivery).

- Either way, proceed to Step 4.

Step 4: If the supplier refuses your main request, is there a viable alternate lever?

- Yes → Choose one alternate lever: deposit split, milestone structure, early-pay discount, or a term ladder.

- No → Proceed to Step 5.

Step 5: Is supply from this supplier critical enough to accept worse terms temporarily?

- Yes → Accept current terms with a pre-agreed review date and documented term improvement path.

- No → Qualify alternative suppliers to create options and reduce dependency.

This framework helps you adapt your approach based on relationship maturity, payment history, and supply criticality rather than using a one-size-fits-all script.

Protect Relationships While Protecting Cash

Negotiating harder terms does not have to mean damaging relationships. The framing matters enormously. Approaching suppliers as partners rather than adversaries creates space for solutions that work for everyone.

Share context without oversharing. You do not need to open your books, but explaining that your customer payment cycles create cash pressure helps suppliers understand why you are asking. Most suppliers have faced similar pressures themselves and can appreciate the challenge.

Use language focused on mutual stability. Phrases like “predictable business,” “long-term partnership,” and “reliable ordering patterns” signal that you are thinking beyond the immediate transaction. Suppliers extend better terms to customers they trust will still be around and paying next year.

Consider the supplier’s perspective explicitly. They have their own cash cycles, their own risks with new customers, and their own experiences with buyers who promised reliability and then disappeared. Acknowledging these concerns builds credibility.

Better terms often come from being the lowest-risk small buyer, not the loudest negotiator. Share clean documentation like purchase orders, specifications, and delivery windows. Pay on time and communicate early if something changes. Keep requests neutral: frame them as “aligning timing” rather than “supplier is squeezing us.”

Align your internal stakeholders so procurement does not commit to terms that finance cannot support. For guidance on this internal coordination, see aligning finance and procurement priorities.

Suppliers extend better credit when they can predict buyer behavior and demand. Reliability becomes leverage. Demonstrating consistent payment patterns, clear communication, and accurate forecasting transforms you from a risky small account into a valued, predictable partner.

Common Questions About Negotiating Payment Terms

Can I negotiate payment terms as a very small paper bag buyer?

Yes, though leverage for small buyers comes from ‘soft power’ rather than volume. While you cannot dictate terms like a major mill, you can negotiate incremental improvements by trading predictability (reliable forecasts) and demonstrating payment discipline for better terms. The best path is usually staged: trial orders, on-time payment proof, then a term ladder. Many suppliers prefer stable small customers over unpredictable large ones.

What if my supplier flatly refuses to improve payment terms?

Start by understanding why. If it is a blanket policy, ask about exceptions for proven customers. If they have had bad experiences with credit extensions, offer to prove yourself through smaller orders first. Shift from “terms” to “structure”: smaller deposits, milestone payments, delivery-triggered balances, or a review date after a few successful orders. Consider whether the relationship offers enough value to continue under current terms, or whether diversifying your supplier base might give you better options and reduce working capital strain.

How do payment terms interact with Incoterms?

Incoterms define who handles logistics, insurance, and risk at each stage of shipment, while payment terms define when money changes hands. They interact because terms like CIF bundle more costs upfront, affecting your cash-out timing, and because risk transfer points can influence when suppliers insist on receiving payment. Understanding both together helps you evaluate the true cost and cash impact of any supplier arrangement. Payment terms and Incoterms should be evaluated as part of your total cost and cash timing picture.

Is it ever worth accepting worse terms to secure critical supply?

Sometimes, yes. During shortages or when a supplier offers unique quality or capabilities, accepting less favorable terms may be the right trade-off. If stock availability is existential to your operations, temporary acceptance may be necessary. The key is making that choice consciously, understanding the cash impact, locking in a review date, and documenting a step-up path such as “after three on-time payments, shift to Net 15.” Work to improve terms once the relationship is established and your reliability is proven.

For buyers exploring new supplier relationships, PaperIndex serves as a neutral B2B marketplace connecting buyers with verified paper bag suppliers globally, with free RFQ submission to receive competitive quotes.”

References

For readers who want to verify concepts or dive deeper:

- Incoterms® 2020 rules overview: U.S. International Trade Administration guidance

- Incoterms educational resources: International Chamber of Commerce (ICC) Academy

- Net payment terms explained: BILL: Understanding Net 30 payment terms

- UCC payment terms guidance: National Contract Management Association reference guide (referencing Cornell Law’s UCC source)

Disclaimer:

This guide is for general educational purposes only and does not constitute financial, legal, or tax advice. Readers should consult qualified professionals in their jurisdiction before making credit or contract decisions.

Our Editorial Process:

Our expert team uses AI tools to help organize and structure our initial drafts. Every piece is then extensively rewritten, fact-checked, and enriched with first-hand insights and experiences by expert humans on our Insights Team to ensure accuracy and clarity.

About the PaperIndex Insights Team

The PaperIndex Insights Team is our dedicated engine for synthesizing complex topics into clear, helpful guides. While our content is thoroughly reviewed for clarity and accuracy, it is for informational purposes and should not replace professional advice.