📌 Key Takeaways

Single-source corrugated box suppliers create hidden risks—missed shipments, quality drift, and lost negotiation power—that expedited freight and emergency orders cannot fix.

- Diversification Protects Continuity: Qualified backup suppliers transform supply disruptions from operational emergencies into manageable process adjustments.

- Not Every Category Needs Backups: Use the Kraljic Matrix to prioritize diversification for high-impact packaging with vulnerable supply chains.

- Phased Implementation Prevents Chaos: A 30–90 day blueprint—locking specs, verifying suppliers, staging allocation—prevents the quality drift that rushed diversification creates.

- Qualification Gates Protect Quality: Documentation alignment, capability evidence, and controlled trial orders ensure backups match primary supplier performance before scaling.

- System Failures Mimic Supplier Failures: Environmental friction, missing cushioning specs, and stacking issues often cause box failures that switching suppliers cannot solve.

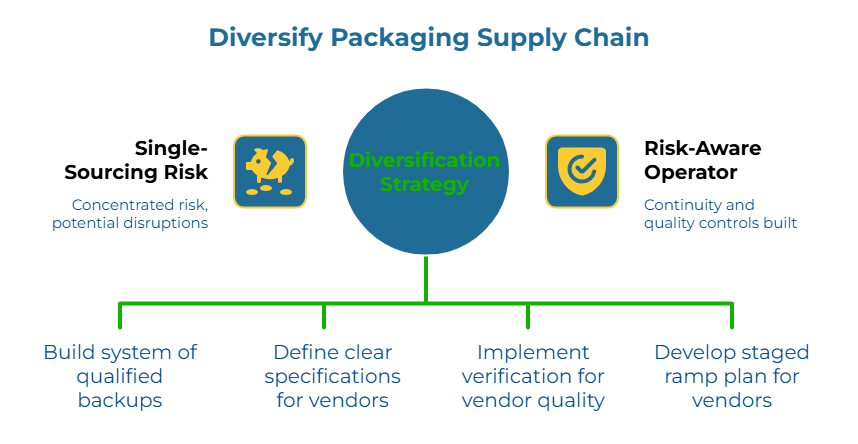

Diversification means building controlled qualification systems, not collecting vendor names.

Procurement managers and packaging engineers sourcing corrugated boxes will gain a practical roadmap for building supply resilience, preparing them for the implementation frameworks that follow.

In electronics and appliances, corrugated packaging is the product’s ‘body armor.’ Sourced from specialized manufacturers, these protective materials form the first line of defense against transit damage.” When it fails, damage claims and escalations follow. Reliance on a single corrugated supplier creates a high-stakes bottleneck; a single missed shipment can exhaust safety stock within days, threatening a total line stoppage; however, the absence of a verified contingency means a full operational stoppage is imminent.

This is the ‘supply shock’ moment that procurement managers and packaging engineers dread—and it exposes a fundamental truth about single-sourcing that unit price comparisons never capture.

Single-sourcing can look efficient, but it concentrates risk. A single missed shipment, spec change, or quality drift can force expedited freight, repacking, and compounded customer friction.

Diversification is not “adding vendors”; it’s building a controlled system of qualified backups with clear specs, verification, and a staged ramp plan. Think of packaging as operational insurance—failure shows up as returns, downtime, and failure manifests as returns, downtime, and contractual penalties. The goal is to become a risk-aware operator who builds continuity and quality controls, not a price-only buyer.

With this framework—developed through insights from the PaperIndex Academy—you can move from reactive scrambling to pre-qualification gates and staged allocation, transforming supplier disruptions from emergencies into manageable process adjustments.

The Hidden Costs of Single-Sourcing (Beyond Unit Price)

A common misconception holds that a cheaper unit price always equals lower total procurement cost—a principle explored in depth in why ‘cheap’ boxes cost more. The reality is more complex. Three primary cost categories hide beneath the surface of single-source arrangements.

Continuity failure costs hit hardest. When your only supplier misses a delivery, you pay for expedited freight at premium rates, production downtime, and labor hours managing the crisis. Consider this scenario: a supplier capacity squeeze forces MOQ increases overnight. Without backups, orders slip and freight goes premium. The operational tax during disruption—expediting, rework, lost time—often exceeds any unit price savings.

Quality drift costs accumulate quietly. A small material change (liner weight reduction, humidity exposure during storage) can increase box failure rates over months. For converters working with containerboard inputs like kraft linerboard or testliner board, even minor specification drift in base materials cascades into finished product failures. Without a second supplier producing the same spec, you have no benchmark for comparison. By the time damage reports spike, thousands of units have shipped in compromised packaging. This directly challenges the misconception that all corrugated boxes are essentially the same commodity—they are not.

Negotiation leverage costs compound over time. When contract renewal arrives, your supplier knows you have no credible alternative. Terms tighten. Lead times extend. The principles of dual sourcing recognize that maintaining qualified alternatives preserves negotiation power even when you prefer your primary supplier.

Fast Triage: Does This Category Need Diversification?

Not every box category requires multiple suppliers. A simple screen helps prioritize where diversification efforts should focus.

A portfolio approach maps two dimensions: profit impact (how critical is this packaging to revenue and customer experience?) and supply risk (how vulnerable is your current source to disruption?). Organizations can find suppliers across multiple regions to reduce geographic concentration risk. Items high on both dimensions warrant diversification investment. This portfolio approach to procurement strategy—detailed in frameworks like strategic sourcing guides—has been recognized in supply chain management literature as a way to match sourcing tactics to business impact.

Triggers that generally indicate diversification is warranted:

- Global shipping lanes with port congestion or customs variability

- Fragile or high-value products where box failure creates expensive returns

- Tight customer SLAs where delivery delays carry penalties

- Supplier opacity around capacity, material sources, or quality systems

- Single-region concentration where weather, labor, or logistics disruptions affect all orders

Three diagnostic questions for fast category assessment:

- If the primary misses one delivery cycle, which critical path fails first—production uptime, fulfillment velocity, or SLA compliance?

- Would incoming checks detect a quiet material change quickly?

- Is the pack-out fully specified (especially cushioning/immobilization), or is “box spec” being mistaken for “packaging system spec”?

If your critical corrugated boxes check two or more triggers, diversification moves from optional to operationally necessary. For a deeper analysis of concentration risk, the PaperIndex Academy guide on hidden risks of single-source procurement explores these dynamics further.

A Practical 30–90 Day Diversification Blueprint

Diversification fails when teams rush to add suppliers without building the foundation first. The mechanism of failure is clear: without spec discipline and trial orders, adding a backup supplier increases variability and can create new quality failures.

A phased approach prevents this chaos.

Days 1–7: Lock the Spec Pack

Before contacting any new suppliers, document exactly what you’re buying:

- Complete technical specifications (flute type, ECT/BCT requirements, dimensions, print specs)

- Acceptance criteria with test methods

- Change-control rules defining what triggers re-qualification

Checklist—What to Document Before Adding a Second Supplier:

- [ ] Current spec sheet with revision number

- [ ] Testing method for incoming inspection

- [ ] Tolerance ranges for critical parameters

- [ ] Change-control protocol (who approves spec changes?)

- [ ] Current supplier’s baseline quality metrics for comparison

This spec pack becomes your single source of truth. Without it, you will receive incomparable quotes and introduce variability the moment a second supplier ships.

Days 8–30: Identify, Verify, and Trial

With specs locked, begin supplier discovery through platforms like PaperIndex’s B2B marketplace or industry directories. When evaluating candidates, the reader’s natural questions arise: Is this supplier verified? Can they meet my specific ECT requirement? How do I ensure the quality matches the sample?

For each candidate discovered through online marketplaces or direct outreach:

- Request capability evidence against your spec pack

- Verify business registration and quality certifications

- Order samples for internal testing

- Run a small trial order through standard receiving inspection

The supplier verification methodology provides a structured approach to moving suppliers from promising to qualified, particularly when working with international sources where on-site visits may not be practical. For strategies on building supplier options when starting from a concentrated position, this guide on diversifying without burning bridges offers practical tactics.

Days 31–90: Staged Allocation and Monitoring

Resist the urge to split volume immediately.

Start backup suppliers at low allocation—perhaps one SKU or one region. Monitor OTIF and quality metrics weekly during ramp. Update your supplier scorecard with actual performance data. Expand allocation only after consistent performance across multiple shipments.

This staged approach lets you catch problems before they scale. Illustrative disruption scenarios make this concrete: an MOQ squeeze from your primary supplier, a quiet liner change combined with humid transit conditions, or lane and port disruption where regional redundancy suddenly matters. Regional redundancy, built gradually, improves lead-time reliability under shipping and port volatility. When a port disruption hits one region, geographic diversity keeps programs running.

Supplier Diversification Matrix

A matrix keeps your diversification strategy visible and actionable. The core structure maps Primary versus Backup suppliers against Region and Capability:

| Region A (e.g., Asia-Pacific) | Region B (e.g., Europe) | Region C (e.g., Americas) | |

| Primary Supplier | Supplier name, verification status, lead time, MOQ, quality gate status | — | — |

| Backup Supplier | — | Supplier name, verification status, lead time, MOQ, quality gate status, switch trigger | Supplier name, verification status, switch trigger |

Key columns to track for each supplier:

- Verification status and date

- Lead time and MOQ (as provided by supplier)

- Quality gate passed? (Yes/No, with test method noted)

- Switch trigger: the specific event that activates backup

The switch trigger column transforms backups from theoretical to operational. Define measurable events: Primary OTIF below threshold for two consecutive months. Capacity constraint notice received. Quality drift beyond tolerance. Port disruption affecting primary lanes beyond a defined duration.

| Supplier | Supplier A | Supplier B | Supplier C |

| Role | Primary | Backup (fast) | Backup (resilience) |

| Region/Lanes | Region 1 / Lane A | Region 1 / Lane A | Region 2 / Lane B |

| Capability Fit | RSC + die-cut | RSC | Die-cut |

| Spec Revision | Spec vX.Y | Spec vX.Y | Spec vX.Y |

| Verification Status | Reviewed (date: ___) | Pending | Reviewed (date: ___) |

| Trial Status | Passed (method: ___) | Scheduled | In progress |

| Re-order Trigger | Inventory hits ___ | Inventory hits ___ | Inventory hits ___ |

| Switch Trigger | Missed OTIF for ___ cycles | MOQ/lead-time change without acceptance | Lane/port disruption constrains Region 1 |

| Notes | Change control contact: ___ | Keep pallet pattern identical | Align print/graphics spec |

Onboarding Without Chaos: Qualification Gates

Qualification gates prevent the quality drift that often accompanies hasty supplier additions. The principle is straightforward: qualification gates (specs + verification + trial orders) prevent quality drift when onboarding secondary suppliers. This approach aligns with established quality management principles for implementing change in a controlled way.

Gate 1: Documentation alignment. Confirm the supplier can produce to your spec sheet, follows a compatible test method, and has revision control in place.

Gate 2: Capability evidence. Request proof the supplier can hold critical specifications consistently. For box converters, this often means verifying upstream relationships with kraft linerboard mills or medium paper producers to ensure material consistency. For high-value programs, a focused audit may be warranted.

Gate 3: Controlled trial orders. Ship a small lot through standard receiving inspection. Compare results to your primary supplier’s baseline. Only suppliers passing this real-world test earn allocation.

These gates require time upfront but prevent expensive rework cycles. For a comprehensive framework, from fragile to fortified details the strategic approach to building resilient sourcing.

Diagnosing the System: When It’s Not the Supplier

Sometimes box failures persist even after diversification. Before blaming suppliers, investigate system-level causes.

Environmental friction affects all suppliers equally. Global shipping involves varying humidity levels that weaken paper strength, plus rough handling at ports that stresses even well-designed boxes. If damage patterns correlate with shipping routes rather than suppliers, transit conditions may be the issue—not the box itself.

Human error patterns hide in plain sight. Procurement teams frequently fail to specify cushioning requirements in the RFQ. The result: boxes that meet every technical spec but still fail because the product inside lacked proper protection. An “in-spec” box can still be wrong for the application.

False diagnosis traps waste budget. The reflexive response to breakage is often buying thicker boxes. But if the failure mode is crushing from stacking or puncture from handling, heavier liner will not help. Better-engineered inserts, corner protectors, or load distribution often solve problems that thicker corrugated cannot. Understanding the role of fluting paper and other structural components helps procurement teams specify the right protection, not just more material. This is the difference between treating symptoms and addressing root causes.

Risk management frameworks like ISO 31000 emphasize identifying the actual source of risk before selecting treatments—a principle that applies directly to packaging failures.

Keeping Diversification From Increasing Complexity

Multiple suppliers can multiply administrative burden without deliberate standardization.

Standardize RFQ language and specs, using proven templates like the corrugated box RFQ checklist. When all suppliers quote against identical requirements, comparisons become meaningful. Your spec pack does this work. Include copy-paste specification clauses in every RFQ to ensure consistency.

Use a single scorecard. Evaluate all suppliers—primary and backup—against the same metrics: OTIF, quality acceptance rate, responsiveness, documentation accuracy.

Build re-order triggers. Define thresholds that trigger automatic review rather than relying on manual decisions. A primary supplier’s OTIF dropping below target for two consecutive periods initiates formal allocation discussion.

Document what stays single-sourced. Some low-risk categories may not warrant diversification overhead. Make that decision explicit and revisit annually. Research on supply chain resilience consistently identifies diversification and safety stock as key levers. To specifically mitigate supply disruption risks, safety stock is calculated using the formula:

Ss = Z x 𝜎LT x Davg

where Z is the service level factor (standard normal variate), 𝜎L is the standard deviation of lead time, and Davg is the average daily demand. This specific calculation isolates the impact of lead time variability—the primary risk in single-source scenarios.

Common Questions About Diversification

Is dual sourcing always better?

Dual sourcing reduces continuity risk, but it adds coordination overhead. The decision depends on category impact and supply vulnerability. High-impact categories with concentrated supply risk benefit most from diversification, while low-risk items may not justify the management complexity.

How many suppliers are enough?

A common starting point is one primary plus at least one qualified backup with an explicit switch trigger. For mission-critical categories, geographic diversity across two or three regions may be warranted. The goal is controlled switchability, not maximum supplier count.

When should a backup be activated?

Activation should be tied to predefined triggers—missed OTIF cycles, unapproved spec changes, capacity constraints, or lane disruption. Document these triggers in your supplier matrix so activation decisions are systematic rather than reactive.

What to Do Next

Building a resilient packaging supply chain starts with mapping current single-source dependencies, then systematically expanding your qualified supplier network. Buyers can connect with suppliers to begin building that second-source capability today.

For supplier discovery once specs are locked, browse corrugated box suppliers or explore corrugated box product listings to begin building a qualified shortlist. For buyers ready to issue formal requests, you can submit RFQ & receive quotes free to accelerate the qualification process.

For the verification framework to move candidates from discovery to qualification, the Trust Protocol guide walks through evidence-gathering systematically.

Diversification is not about having more vendors. It is a controlled qualification system that protects continuity, quality, and negotiation leverage—so the next supply shock becomes a process adjustment, not an emergency.

Disclaimer:

This content is for informational and educational purposes only. It does not constitute professional procurement, legal, or financial advice. Specific sourcing decisions should be based on your organization’s requirements and consultation with qualified professionals where appropriate.

Our Editorial Process:

Our expert team uses AI tools to help organize and structure our initial drafts. Every piece is then extensively rewritten, fact-checked, and enriched with first-hand insights and experiences by expert humans on our Insights Team to ensure accuracy and clarity.

About the PaperIndex Insights Team:

The PaperIndex Insights Team is our dedicated engine for synthesizing complex topics into clear, helpful guides. While our content is thoroughly reviewed for clarity and accuracy, it is for informational purposes and should not replace professional advice.