📌 Key Takeaways

Certificates prove a supplier’s claims at one moment—ongoing verification systems prevent compliance drift as formulations, sites, and regulations change.

- Certificates Are Snapshots, Not Shields: A Declaration of Compliance becomes stale the moment a supplier changes coatings, inks, or production sites without notification.

- Scope Mismatch Causes Silent Failures: Documentation covering “paper” generically fails when the actual product includes functional coatings, adhesives, or printing inks with distinct migration profiles.

- Four Gates Block Four Failure Modes: Identity verification, document-to-law mapping, independent validation, and ongoing monitoring each prevent a specific category of compliance breakdown.

- Risk Tiering Matches Effort to Exposure: High-volume or direct-contact suppliers warrant annual reviews and 30-day triggered re-validation; low-exposure relationships can use lighter protocols.

- Change Control Beats Document Collection: Written supplier commitments to notify before formulation changes matter more than thick certificate folders reviewed only at onboarding.

Verification systems confirm what certificates actually cover—today, not when you first approved them.

Procurement managers and QA professionals responsible for food-contact packaging will find a stage-gate framework and copy-paste templates here, preparing them for the detailed implementation guidance that follows.

~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~

The audit request arrives at 4:47 PM on a Thursday.

A customer’s quality team needs documentation for every food-contact packaging supplier within 48 hours. The folder looks complete. Declarations of Compliance sit neatly organized by supplier name. ISO certificates show valid dates. Everything appears ready.

Then someone asks a question no one can answer: Does that certificate actually cover the coated liner you’ve been receiving since the supplier changed their coating formulation six months ago?

This moment exposes a gap that standard supplier onboarding advice never addresses. The conventional wisdom—conduct thorough document review when you first qualify a supplier—is necessary. But it fails when monthly volumes climb past 50 metric tons, when suppliers operate across multiple production sites, or when formulations quietly change between audits. Without change control and periodic validation, suppliers remain “approved on paper” while production reality diverges.

This approach transforms compliance from a static checklist into a dynamic gate system. Food contact compliance verification is the systematic process of validating supplier claims and documentation against regional food-contact rules and real production conditions. Think of it as passport control for your supply chain: documents matter, but verification confirms identity, scope, and legitimacy. This framework provides a validation-driven vetting process that can be operationalized with clear ownership and cadence—and kept current through defined re-validation triggers.

Continuous, neutral verification is the only reliable defense against compliance drift in high-volume global supply chains.

Not legal advice: This article shares a structured verification approach and widely accepted compliance-management practices. Specific regulatory obligations vary by country, material construction, and intended use; regulatory counsel and qualified testing partners should be consulted when decisions carry elevated risk.

The Mechanics of Compliance Drift

Most compliance failures don’t stem from negligence. They stem from treating documentation as a checklist rather than a living system with change control.

Certificates Are Snapshots; Reality Changes

A Declaration of Compliance (DoC) represents a supplier’s attestation at a specific moment, contingent upon defined production parameters, raw material batches, and specific regulatory versions. Food contact materials (FCM) regulations—whether Regulation (EC) No 1935/2004 in Europe or FDA regulations including 21 CFR Part 175 (adhesives/coatings) and 21 CFR Part 176 (paper) in the United States—establish frameworks suppliers must meet. The certificate itself doesn’t update when a supplier changes coating suppliers, modifies ink formulations, or shifts production to a different facility.

The absence of incidents creates a dangerous false confidence. Teams assume that if nothing has gone wrong, the supplier must still be compliant. Meanwhile, the gap between documentation and production reality widens with every unreported change.

Scope Mismatch: The Silent Failure Mode

A certificate can be entirely legitimate and still be wrong for your specific application.

This happens when the declaration covers “paper and paperboard” generically while the actual product includes functional coatings, adhesives, or printing inks—each with distinct migration profiles. It happens when testing conditions don’t match real-world use: migration tests run at 40°C for 10 days generally simulate long-term storage at room temperature or below, but fail to capture the kinetics of the 100°C contact required for hot beverages in paper cups. It happens when regulatory scope covers one jurisdiction while shipments move into another with different specific migration limits (SMLs).

A supplier might hold valid EU compliance documentation while the specific grade being purchased has never been tested against FDA indirect food additive requirements. Understanding how to verify food-grade certification standards for delivery packaging helps prevent this scope mismatch. Both regulatory frameworks require compliance. Neither certificate automatically proves compliance for the other.

Mixed Materials Multiply Risk

Modern food-contact packaging rarely consists of paper alone. A sandwich wrap might include base paper substrate, a functional coating for grease resistance, printing inks for branding, and adhesives if it’s a laminated structure.

Each component has its own compliance pathway. The European Commission’s guidance on food contact materials establishes that the finished article must comply as a whole—migration from coatings and inks matters as much as the paper substrate. A DoC covering only base paper provides false confidence when the coating is where migration risk actually concentrates.

Multi-region requirements compound this complexity. A single certificate rarely satisfies all jurisdictions when packaging moves across borders.

The Supplier Shield Matrix: A Four-Stage Verification Model

Passport control doesn’t work by glancing at document covers. Border agents verify identity, check validity, confirm the visa matches the destination, and flag travelers whose status has changed. The Supplier Shield Matrix applies this logic through four gates, each blocking a distinct failure mode. This approach aligns with broader governance frameworks for sourcing that move organizations from reactive checking to systematic verification.

Why neutral verification improves quality: When verification is conducted independently—without commercial stake in the outcome—the incentive to overlook gaps disappears.

| Stage | Gate | Failure Mode Blocked | Primary Owner | Cadence |

| 1 | Identity & Scope | Fraud, entity mismatch, undefined product boundaries | Procurement | Onboarding |

| 2 | Document-to-Law Mapping | Jurisdiction gaps, wrong regulation, incomplete material coverage | QA | Onboarding + changes |

| 3 | Independent Validation | Unverifiable claims, expired certifications, irrelevant testing | QA | Annual + triggers |

| 4 | Monitoring & Re-validation | Compliance drift, undisclosed changes, volume-driven risk creep | Procurement | Ongoing |

Each stage builds on the previous. Skipping Stage 1 means validating documents from an entity that might not actually be the supplier. Skipping Stage 4 means airtight onboarding degrades the moment production conditions shift.

Tiering Verification Effort by Exposure

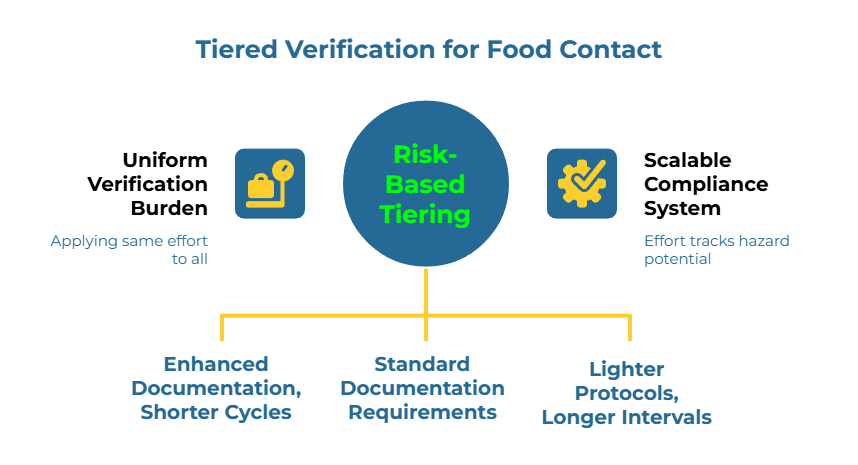

Not every supplier warrants identical scrutiny. Risk tiering matches verification depth to actual exposure—a generally accepted practice that ensures effort tracks both hazard potential and business impact.

High exposure applies to suppliers providing packaging for high-volume items, products with prolonged direct food contact, or items served to vulnerable populations. These relationships require all four stages with enhanced documentation and shorter review cycles.

Medium exposure covers suppliers of secondary packaging or items with brief, incidental food contact. Standard documentation requirements apply across all stages.

Low exposure includes suppliers of items with no direct food contact or minimal volume. Stages 1 and 2 apply fully; Stages 3 and 4 can use lighter protocols with longer review intervals.

This tiered approach reflects a core principle: compliance verification is a system design problem, not a paperwork collection task. The system must scale intelligently rather than applying uniform burden regardless of risk.

Stage 1: Identity and Scope Gate

Before evaluating a single certificate, confirm the supplier’s identity and define exactly what’s being purchased.

Legal Entity Verification

The company name on a quote doesn’t always match the legal entity appearing on shipping documents, invoices, or certificates. Verification requires checking the registered business name against official registries—Companies House in the UK, state corporation databases in the US, national registries elsewhere. Domain and email alignment matters: communications should originate from addresses matching the company’s official website, not lookalike domains. Physical address verification confirms the location corresponds to actual manufacturing or trading operations.

These checks sound basic. In practice, a systems view of supplier verification and risk mitigation demonstrates that identity confirmation catches a meaningful percentage of problematic suppliers before compliance conversations begin. Organizations maintaining rigorous vetting standards—such as those accepting only suppliers that meet multi-layer verification criteria — consistently report higher-quality supplier relationships.

Defining Product Scope Precisely

Generic approvals create generic problems. Onboarding documentation should capture exact product specifications including paper grade, basis weight (g/m²), coating type, and ink system (water-based, UV-cured, or other). When sourcing food grade kraft paper, these specifications become particularly critical for compliance verification. The intended food contact application matters: direct contact with hot fatty foods differs fundamentally from incidental contact with dry goods. Target markets must be specified to determine which jurisdictions require compliance documentation.

This scope definition becomes the reference point for all subsequent verification. When a supplier sends a DoC, immediate comparison against the defined scope reveals whether coverage actually extends to what’s being purchased.

The one-paragraph test: A reviewer should be able to describe the exact product and use case in one paragraph without guessing. If “food-safe” language remains generic, layers are unspecified, or the product isn’t uniquely identifiable, the scope gate has not been passed.

Traceability Fundamentals

Batch and lot identification protocols establish how specific shipments trace back to production records. This matters less for initial compliance verification and more for incident response—if problems emerge, clear traceability identifies which deliveries might be affected. Suppliers should demonstrate systematic lot traceability as a baseline expectation.

Stage 2: Document-to-Law Mapping Gate

With identity confirmed and scope defined, the next gate verifies that documentation actually covers the use case.

Regulatory Anchors

In the EU, food contact materials are governed by a framework approach under Regulation (EC) No 1935/2004, supported by Good Manufacturing Practice requirements under Regulation (EC) No 2023/2006. In the United States, FDA regulates indirect food additives for paper and paperboard components under 21 CFR Part 176, including sections addressing contact with aqueous and fatty foods as well as dry foods.

What to Request: The Evidence Pack

A complete evidence pack for food-contact packaging typically includes:

- Declaration of Compliance specific to the product and regulation (EU 1935/2004, FDA, or both as applicable)

- Technical specification sheet detailing composition, coating chemistry, and processing conditions

- Migration testing summary covering overall migration and specific migration for substances of concern

- Change control statement confirming notification procedures for formulation modifications

- Certification copies (ISO 9001, FSSC 22000, BRCGS [formerly BRC Packaging], or equivalent) with current validity dates

When qualifying food packaging paper mills, requesting this complete evidence pack at the outset prevents qualification delays. For guidance on structuring these requests systematically, a remote audit checklist demonstrating evidence-first supplier vetting provides a practical template.

Mapping Claims to Regions and Applications

Each document requires verification against three questions. Does the DoC explicitly name the specific regulation required—not just “food contact regulations” generically? Do migration testing conditions match the actual application (temperature, contact time, food simulant type)? Does coverage extend to all components, including coatings and inks, not just substrate?

Common Documentation Gaps

Several patterns indicate incomplete coverage. Generic declarations citing regulatory frameworks without specifying positive lists, SMLs, or testing protocols provide insufficient evidence. Missing coating or ink coverage—where the DoC addresses “paper” but the product includes functional coatings or printing—leaves significant risk unaddressed. Outdated testing conducted on formulations that have since changed offers historical information rather than current compliance evidence. Jurisdiction misalignment, where EU documentation supports US-destined products without bridging evidence, creates regulatory exposure.

When gaps appear, escalation to Stage 3 with specific questions produces better outcomes than accepting partial documentation.

Stage 3: Independent Validation Gate

Documents communicate what suppliers claim. Validation confirms whether claims withstand scrutiny.

Registry-First Verification

Where registries exist, use them. ISO certification bodies maintain searchable databases for verifying certificate numbers, scope statements, and validity periods. Business registries confirm legal entity status and registered addresses. The FDA’s guidance on Food Contact Substance Notifications explains the FCN process for substances cleared through that pathway.

This registry-first approach—checking claims against independent sources rather than accepting supplier-provided documents at face value—separates verification from documentation collection. Visual verification of certificates against known formats helps identify potential issues; resources exist for spotting inconsistencies between authentic and questionable ISO, FSC, and PEFC certificates.

When Additional Evidence Is Required

Evidence requirements should escalate when suppliers cannot provide migration testing data specific to current formulations, when testing comes from in-house laboratories without ISO 17025 accreditation, when products involve novel coatings or barrier technologies, or when entering new jurisdictions. Buyers evaluating food grade kraft paper suppliers should apply these escalation criteria consistently across their supplier base. In these situations, independent laboratory analysis or comprehensive technical dossiers demonstrating compliance through actual chemistry—not just attestation—constitute necessary evidence.

Evaluating Laboratory Reports

Migration testing reports require verification across several dimensions. Laboratory accreditation should confirm ISO 17025 status for the specific test methods employed. Test conditions—temperature, time, and food simulant—must match the intended application. Substances tested should include relevant specific migration limits for materials present in the product. The testing date and formulation version should correspond to current production, not historical formulations.

A lab report from 2019 testing a formulation changed in 2023 provides historical data, not current compliance evidence.

A note on test selection: Test selection and acceptance criteria vary by jurisdiction and by material construction. The goal is not to prescribe a single “correct” test suite, but to ensure any evidence offered is aligned to the claim and defensible under the conditions of actual use.

Stage 4: Monitoring and Re-validation Gate

Compliance at onboarding doesn’t guarantee compliance at delivery. This stage prevents drift before it becomes an incident—because ongoing monitoring costs far less than incident response.

Re-validation Triggers

Clear triggers should prompt return to earlier verification stages.

Automatic triggers requiring immediate action include supplier notification of formulation, coating, or ink changes; production site changes or new sub-suppliers for key components; expansion into new jurisdictions requiring additional compliance; and customer complaints or regulatory inquiries referencing packaging materials.

Periodic triggers on scheduled review include annual documentation refresh for high-exposure suppliers, biennial review for medium-exposure suppliers, and certificate expiration dates for ISO, BRC, or equivalent certifications.

Soft triggers warranting investigation include noticeable changes in product appearance, odor, or performance; significant volume increases that might prompt supplier production changes; and industry news about regulatory updates affecting relevant product categories.

Cadence by Risk Tier

| Risk Tier | Documentation Refresh | Triggered Re-validation Response | Monitoring Approach |

| High | Annual (required) | Within 30 days | Active tracking of supplier communications |

| Medium | Annual (required) | Within 60 days | Quarterly change inquiry |

| Low | 24-month cycle | Within 90 days | Supplier self-reporting |

For frameworks on calibrating verification intensity to supplier risk, a risk-tier ladder for audit versus trust decisions offers structured methodology.

Lightweight Monitoring Procurement Can Execute

Not every monitoring task requires QA expertise. Procurement functions can handle certificate expiration tracking with renewal triggers, logging supplier communications about changes (even seemingly minor ones), flagging volume increases exceeding defined thresholds, and maintaining calendars of periodic review dates.

Distributed ownership prevents monitoring from becoming a bottleneck while ensuring changes don’t escape notice during routine operations.

Operationalizing the Model: Ownership, Workflow, and Cadence

Frameworks succeed when responsibilities are unambiguous.

Workflow from Discovery to Approved Supplier

The process moves through defined stages: supplier identification by Procurement, Stage 1 verification confirming identity and scope, standardized evidence pack request, Stage 2 regulatory mapping review by QA, Stage 3 independent validation by QA, joint approval decision with documented rationale, and monitoring system setup by Procurement with defined review triggers.

Ownership Clarity Between Functions

| Responsibility | Procurement | QA |

| Identity verification | Primary | — |

| Scope definition | Primary | Advisory |

| Document collection | Primary | — |

| Regulatory mapping | — | Primary |

| Registry validation | — | Primary |

| Lab report evaluation | — | Primary |

| Approval recommendation | — | Primary |

| Final approval decision | Joint | Joint |

| Ongoing monitoring | Primary | — |

| Triggered re-validation | — | Primary |

This division leverages each function’s strengths. Procurement manages supplier relationships and operational logistics. QA provides technical compliance expertise. Both share accountability for approval decisions. For additional structural guidance, a governance model explaining why certificates alone prove insufficient addresses cross-functional alignment.

The Decision Log

Auditors tend to trust consistent systems more than heroic document hunts. Maintain a one-page record per supplier and material covering product identifier and construction summary, intended use and markets, evidence received, risk tier and cadence, exceptions granted (if any) with rationale, and date of last review with next review trigger. This log becomes the defensible record that demonstrates systematic verification rather than ad-hoc collection.

Practical Evidence Pack Request

Checklist with Pass/Fail Criteria

| Document | Required For | Pass Criteria | Fail Criteria |

| Declaration of Compliance | All tiers | Names specific regulation; covers exact product including coatings/inks; dated within 24 months | Generic language; substrate-only coverage; undated or expired |

| Technical specification | All tiers | Details full composition including coatings, inks, adhesives; states basis weight and grade | Missing component details; incomplete composition disclosure |

| Migration test summary | Medium/High | ISO 17025 accredited lab; conditions matching application; current formulation | Non-accredited testing; mismatched conditions; outdated formulation |

| ISO/BRC/FSSC certificate | Medium/High | *Verifiable in issuing body database; current validity | Unverifiable; expired |

| Change control commitment | All tiers | **Written commitment to advance notification of changes | No commitment or vague language |

*For step-by-step registry verification procedures, see how to run a quick registry check for FSC/PEFC certificates.

**For contract language that enforces change notification requirements, see contract clauses that protect against off-spec deliveries.

Supplier Request Template

Subject: Documentation Request for Food Contact Compliance Verification – [Organization Name]

Dear [Contact Name],

As part of supplier qualification for food-contact packaging materials, the following documentation is required for [specific product/SKU]:

- Declaration of Compliance citing [EU Regulation 1935/2004 / FDA 21 CFR 176 / specify as applicable] for the complete finished article including any coatings, inks, or adhesives

- Technical specification sheet detailing composition, basis weight, and coating/ink systems

- Migration testing summary from an ISO 17025 accredited laboratory with test conditions specified

- Current ISO 9001 / FSSC 22000 / BRC Packaging certificate (copy acceptable; independent verification will be conducted)

- Written confirmation of change notification policy for formulation modifications

Documentation must be specific to the product being supplied, not generic company-level declarations.

Review will be completed within [timeframe] of receiving complete documentation. Incomplete submissions will delay qualification.

Internal Summary Format

| Field | Entry |

| Supplier legal name | ____________________ |

| Product scope (grade, coating, application) | ____________________ |

| Target jurisdictions | ____________________ |

| Stage 1 status | Pass / Fail / Pending |

| Stage 2 status | Pass / Fail / Pending |

| Stage 3 status | Pass / Fail / Pending |

| Stage 4 setup | Complete / Pending |

| Risk tier assignment | High / Medium / Low |

| Next scheduled review | ____________________ |

| Approval status | Approved / Conditional / Rejected |

| Procurement signature | |

| QA signature | |

| Conditions or notes | ____________________ |

Self-Audit: Current State Assessment

These ten questions assess whether current processes extend beyond basic documentation collection.

- Identity verification: Are supplier legal entities verified against official registries before certificate review?

- Scope documentation: Is every supplier relationship tied to a specific product scope definition?

- Complete material coverage: Do declarations explicitly address coatings, inks, and adhesives—not substrate alone?

- Jurisdiction mapping: Are documents mapped to each target market’s specific regulatory requirements? For organizations beginning their search for compliant suppliers, food packaging paper suppliers can be evaluated against these ten criteria during initial discovery.

- Independent validation: Are ISO/BRC certificates verified through issuing body databases rather than accepting supplier copies?

- Test condition relevance: Do migration test conditions match actual food contact applications?

- Change control agreements: Do written supplier commitments exist for formulation change notification?

- Expiration monitoring: Are certificate validity dates actively tracked with renewal triggers?

- Risk-based tiering: Are verification requirements calibrated to supplier exposure levels?

- Ownership clarity: Is responsibility for each verification task clearly assigned between Procurement and QA?

Interpretation: Eight or more affirmative answers indicate mature systems where continuous improvement and edge cases warrant focus. Five to seven affirmative answers suggest foundational elements exist but gaps—particularly in material coverage, change control, and jurisdiction mapping—need priority attention. Fewer than five affirmative answers indicate that building from Stage 1 and Stage 2 fundamentals should precede adding complexity.

Starting with Limited Resources

Organizations building from minimal infrastructure can phase implementation practically. A strategic framework for moving from vulnerable to verified sourcing provides a parallel roadmap. During weeks one and two, implement Stage 1 for the top five suppliers by volume—verify identity and document scope. Weeks three and four involve requesting complete evidence packs from those suppliers using the template provided. Month two completes Stage 2 and Stage 3 review for the initial five suppliers while building internal summary templates. Month three extends the process to the next supplier tier and establishes monitoring cadence.

This phased approach builds organizational capability without overwhelming either function.

Building the Shield

The 48-hour audit scramble doesn’t have to repeat. The difference between panic and confidence isn’t more certificates—it’s a verification system confirming what certificates actually mean for specific products, specific markets, and current supplier operations.

Certificates remain necessary. Verification systems must assume suppliers and regional rules change faster than internal paperwork cycles can capture. The misconception that “once approved, always compliant” creates the exposure that audit findings eventually reveal.

Organizations treating compliance as a living system—with gates verifying identity, mapping documentation to applicable law, validating claims independently, and monitoring for drift—transform from document collectors into verification system operators. This systematic approach becomes essential when qualifying food grade kraft paper mills or other food-contact material manufacturers. That transformation builds the strategic shield protecting brand equity and operational continuity across regions and volumes. Explore more procurement frameworks and supplier verification resources at PaperIndex Academy.

The question isn’t whether your suppliers have certificates. The question is whether those certificates actually cover what you’re buying, under the conditions you’re using it, in the markets you’re serving—today, not when you first approved them.

Ready to apply this verification framework? Find suppliers through a neutral marketplace that maintains rigorous vetting standards, or submit your buying requirements to connect with pre-screened food packaging suppliers.

Disclaimer:

This article is intended for general informational and educational purposes only and should not be considered professional or legal advice. Food contact regulations vary by jurisdiction and change over time. Organizations should consult qualified regulatory professionals and review official regulatory sources for specific compliance requirements.

Our Editorial Process:

Our expert team uses AI tools to help organize and structure our initial drafts. Every piece is then extensively rewritten, fact-checked, and enriched with first-hand insights and experiences by expert humans on our Insights Team to ensure accuracy and clarity.

About the PaperIndex Insights Team:

The PaperIndex Insights Team is our dedicated engine for synthesizing complex topics into clear, helpful guides. While our content is thoroughly reviewed for clarity and accuracy, it is for informational purposes and should not replace professional advice.