📌 Key Takeaways

Recurring corrugated box damage traces to specification gaps and supplier control failures, not carrier handling alone.

- Diagnose Before Blaming: Categorize visible failure modes—compression, puncture, humidity damage, or seam separation—to identify whether specs, quality drift, or conversion issues caused the problem.

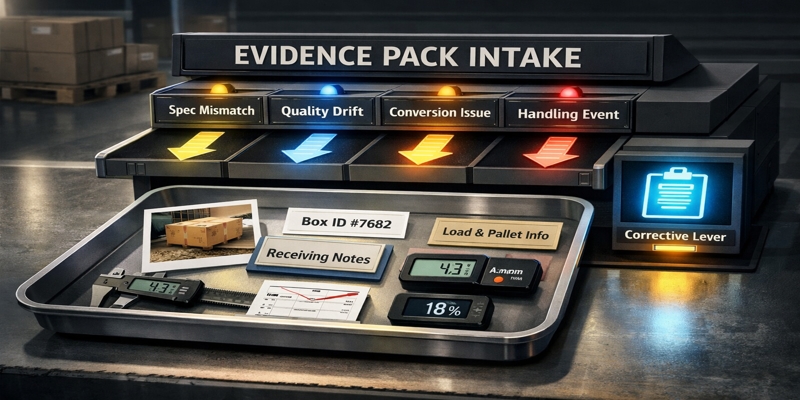

- Evidence Packs Enable Prevention: Standardized damage documentation with photos, box identifiers, pack-out context, and receiving notes reveals patterns that claims processes miss entirely.

- Specs Must Match Reality: A 32 ECT box rated for climate-controlled storage will fail under 85% humidity during summer transit; specifications must define actual distribution hazards upfront.

- Quality Drift Compounds Silently: Lot-to-lot variance in moisture content, flute profiles, or adhesive application creates weak batches even when paperwork shows compliance, requiring incoming inspection triggers.

- Pivot at Scale: Organizations processing above 50,000 units monthly find that machineability specs—moisture stability, caliper consistency, reliable converting—matter more than unit price when single line stoppages cost more than per-unit savings.

Prevention converts incident learnings into enforceable sourcing controls, not reactive claim filing.

Procurement managers and packaging engineers responsible for corrugated box sourcing will gain diagnostic frameworks and specification improvement strategies here, preparing them for the practical implementation protocols that follow.

The assumption seems obvious: if boxes arrive crushed, someone mishandled them.

This default makes sense on the surface. Carriers are visible. Forklifts leave marks. Trucks get delayed in weather. When damage shows up at receiving, the freight invoice sits right there—an easy target for the claim.

But here’s what that assumption misses: the carrier is often the last visible actor in a failure that was engineered upstream.

Damage on arrival reveals a mismatch between packaging capability and the distribution environment. If the box was never specified, built, and controlled to survive the actual hazards your product faces—humidity swings, mixed-load compression, long dwell times on loading docks—then filing claims treats the symptom while the cause keeps repeating. Effective corrugated box sourcing prevents repeat in-transit product degradation when specs and supplier controls are aligned to real distribution hazards.

The Myth: Damage on Arrival Is a Carrier Problem

Organizations default to blaming logistics for understandable reasons. Handling events are visible. Claims processes exist. And when a crushed shipment arrives, someone needs to answer for it.

The problem is that this creates a predictable loop: file a claim, argue liability, maybe recover partial losses, then wait for the next incident. A recurring situation many procurement teams face is the “blame triangle”—operations points at the carrier, the carrier points at the warehouse, the supplier points at the purchase order, and no one gets closer to prevention.

A claims-first mindset creates disputes but not learning. If the same failure pattern appears across different carriers, routes, or seasons, the root cause isn’t in the truck.

In general packaging engineering practice, damage is the interaction of distribution hazards—stacking, drops, clamp pressure, vibration, humidity, mixed loads—and packaging capability. Capability is set by sourcing decisions: the performance spec, the construction including flute profile, and the supplier controls that keep the finished box consistent over time.

While Incoterms® rules define where risk transfers between parties, they offer no protection against a fundamentally weak packaging system.

The Reality: Sourcing Defines What the Packaging System Can Survive

Sourcing systems define corrugated box performance through specs, qualification, and change control. When you select a supplier and approve a specification, you’re making a bet that the box will perform under conditions you may or may not have fully defined.

Consider what “performance” actually means in corrugated packaging—and why strategic sourcing frameworks must define survivability, not just specifications. A box rated for a certain Edge Crush Test (ECT) value assumes specific conditions—stacking height, humidity range, dwell time. If your spec says “32 ECT” but doesn’t account for 85% relative humidity during a cross-country summer transit, the box isn’t defective. It’s doing exactly what a 32 ECT box does under those conditions.

The carrier didn’t cause the failure. The gap between your specification and reality did. When a specification fails to account for environmental stressors, the burden of proof shifts from the carrier’s handling to the procurement team’s planning.

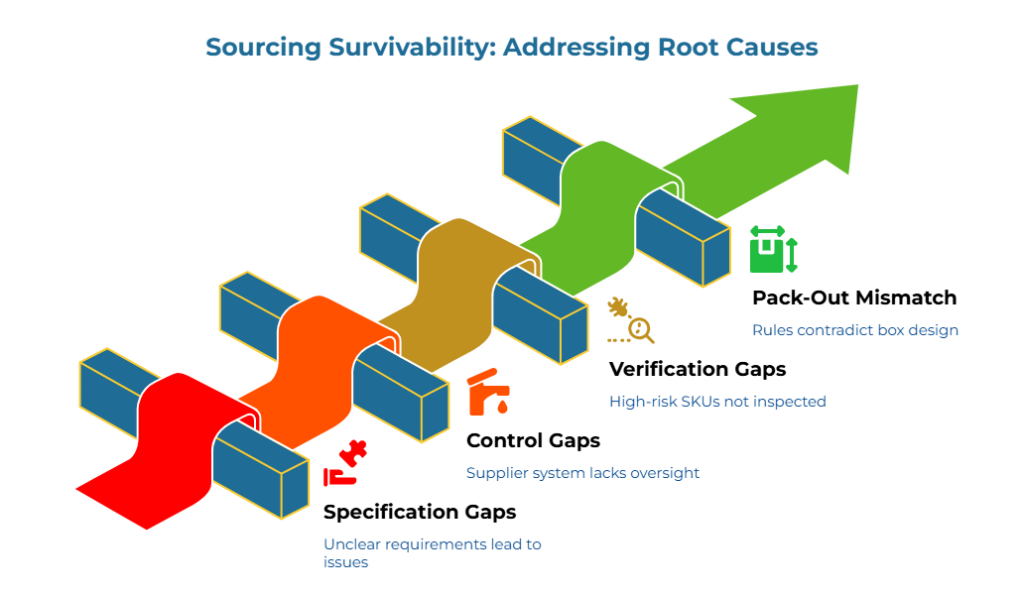

What Sourcing Failure Looks Like in Corrugated Packaging

“Sourcing failure” doesn’t mean you selected a bad supplier. It means the system governing specs, variance, and change control wasn’t calibrated to your actual distribution environment. Three patterns appear repeatedly:

Spec mismatch. The box was never specified for the real hazards. Perhaps the ECT rating assumes climate-controlled warehouse storage, but the product actually sits on humid loading docks. Perhaps stacking strength calculations assume single-high pallets, but mixed loads in transit create unpredictable compression. Relying on one indicator—burst strength alone, or an ECT grade without context—often under-defines survivability. Defining and enforcing corrugated box specs requires naming exact test methods, conditioning protocols, and acceptance criteria that reflect real distribution hazards. Testing standards like ISO 3037 for edge crush testing or ISO 2758 for burst strength provide the methodology, but only if you specify requirements that reflect your actual conditions.

Quality drift. The supplier meets nominal specs on paper, but lot-to-lot variance creates occasional weak batches—a pattern that creates compliance risk in pharmaceutical packaging where evidence retrieval during QA release is mandatory. Moisture content fluctuates. Flute profiles shift slightly between production runs. A single change in board quality or conditioning can tip a high-volume system from stable to fragile—not because anything officially “changed,” but because variance finally crossed a threshold. This is why unit-price savings often spike total cost of ownership when quality variance creates downstream operational costs.

Conversion and build issues. The board grade is adequate, but construction details undermine performance. Scoring that’s too deep weakens fold lines. Adhesive that doesn’t cure properly under fast-line conditions. Print coverage that changes moisture absorption. The raw material meets spec; the finished box doesn’t perform.

Each pattern requires a different corrective lever—which is why diagnosis must precede action. When corrective action requires new suppliers or backup qualification, platforms like PaperIndex’s corrugated box supplier directory enable systematic discovery of manufacturers and exporters.

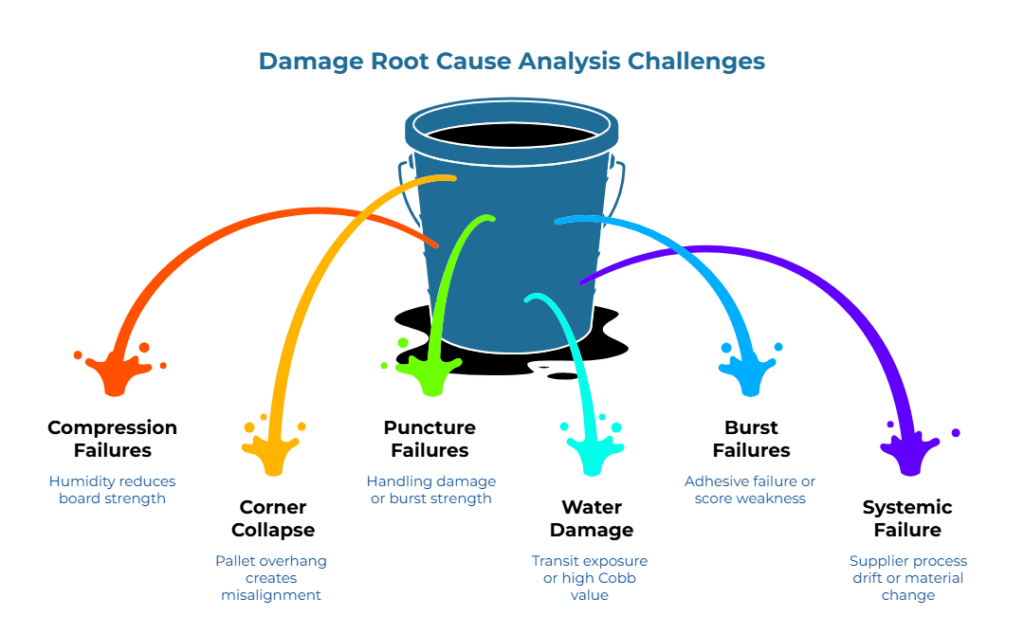

Diagnostic Framework: Categorizing Failure Modes

Before assigning blame, categorize what you observe. Failure-mode diagnosis enables targeted corrective actions instead of generic blame or over-specification.

Different visible patterns point to different upstream causes:

Compression or crush (boxes flattened, corners buckled) typically indicates a mismatch between stacking strength and actual load, or board that lost strength due to moisture exposure. ECT measures raw material strength; Box Compression Test (BCT) evaluates finished container performance. Real-world performance can fall significantly below lab values when humidity enters the picture.

Puncture or tear (holes, rips, gouges) often signals handling damage, sharp contact points in the load, or inadequate burst strength for the distribution environment. The key question: are puncture locations random, suggesting handling, or consistent, suggesting load configuration or product edges?

Water or humidity damage (soft walls, warped panels, mold) indicates exposure during storage or transit, or a Cobb value that doesn’t match the moisture risk of the route. Tropical shipping lanes and seasonal humidity spikes create conditions that temperate-climate specs may not anticipate.

Burst or opening failures (seams separating, flaps popping) point toward adhesive failure, boxes filled beyond rated capacity, or scoring and fold issues from conversion. Clean seam separation suggests adhesive problems; torn board at seams suggests overfill or design stress.

The Minimum Evidence Pack

Standardize what you capture for every incident so patterns become visible over time:

- Photos: Damage from multiple angles, including interior views showing product position

- Shipment context: Stacking arrangement, pallet condition (overhang, wrap/straps, stacking height, wetting signs), visible water exposure, load position in vehicle

- Box identifiers: Dimensions in mm, box style, flute profile if marked or known, lot number or supplier reference, supplier/plant identification

- Pack-out context: Void fill type, product mass in kg, product weight distribution, pallet overhang, strap or stretch wrap tension, closure method

- Receiving notes: Exceptions recorded at delivery (timestamps, “seen before de-palletizing?”), temperature or humidity observations if available

- Quick checks if tools exist: Spot caliper for thickness, seam/joint visual inspection, moisture indicator readings. For detailed dock-side protocols, PaperIndex Academy’s corrugated box quality verification guide walks through the seven checks to complete before signing the Bill of Lading

This evidence pack becomes the foundation for diagnosis—and for fair accountability discussions.

Damage Root Cause Analysis: A Diagnostic Framework

Use this framework to move from visible damage to likely cause to corrective action. The goal is to identify which lever—spec, supplier control, pack-out, or carrier accountability—addresses the actual problem.

1. Compression or Crush Failures

First check: Was the box exposed to high humidity before or during transit? Look for soft walls, damp feel, or visible condensation marks.

- If humidity exposure is evident → Likely cause: moisture reduced board strength below functional threshold → Corrective lever: tighten moisture content specifications, add conditioning requirements, assess route climate risk, consider moisture-resistant treatments

- If no humidity evidence → Check whether actual stacking load exceeded rated compression strength

- If yes → Likely cause: spec mismatch between rated performance and real distribution conditions → Corrective lever: define survivability assumptions in the spec; align palletization to load paths; validate compression capability using ASTM D642 (a common reference for box compression testing)

- If no → Likely cause: quality drift or weak production lot → Corrective lever: implement incoming inspection protocol, strengthen supplier variance controls

2. Corner Collapse

First check: Is the damage concentrated at corners while panels remain mostly intact?

- If yes → Likely cause: pallet overhang creating misaligned load patterns, strap tension damage, or scoring/joint construction issues → Corrective lever: tighten pallet pattern and overhang limits; add conversion acceptance checks for scoring depth and joint quality

3. Puncture or Tear Failures

First check: Are there visible forklift tine marks, impact points, or sharp-object contact patterns?

- If handling marks are visible → Likely cause: carrier or warehouse handling damage → Corrective lever: document for claim, add edge protection or handling controls, review handling protocols with logistics partners

- If no clear handling evidence → Likely cause: burst strength inadequate for product weight, or tears track conversion features (scores, joints) under closure stress → Corrective lever: revise burst strength specification when contact is evident; tighten joint/scoring/closure controls when tears follow construction features; consider redesigning inner packaging and cushioning systems to control product movement and absorb distribution shocks that the outer box alone cannot manage

4. Water or Humidity Damage

First check: Was there visible condensation (tide lines, saturation, warp), pooling, or container rain evidence?

- If direct water exposure is evident → Likely cause: transit or storage exposure event → Corrective lever: investigate container integrity, improve pallet base protection and exception logging, add desiccants or container liners for high-risk routes, review storage protocols

- If no direct exposure but board is soft or shows stiffness loss → Likely cause: board Cobb value too high for ambient humidity conditions, or moisture content/conditioning variability → Corrective lever: specify lower Cobb value, add moisture resistance requirements to supplier specs, define conditioning expectations and receiving checks for high-risk lanes/SKUs

5. Burst or Opening Failures

First check: Did seams separate cleanly, or did the board itself tear at the seam?

- If clean separation → Likely cause: adhesive failure due to cure time, adhesive type mismatch, or application inconsistency → Corrective lever: conversion audit, standardize closure spec and method, adhesive specification review with supplier, add joint-quality controls and traceability

- If board tore at seam → Likely cause: over-capacity fill creating stress concentration, or score-line weakness → Corrective lever: pack-out audit to verify fill weights, box design review for scoring depth

Systemic Failure Warning: If the same failure mode appears across multiple lots, carriers, or time periods, suspect supplier process drift or an undisclosed material change. This is vendor risk, not a logistics debate. Review recent Mill Test Reports (MTRs) or Certificates of Analysis (COAs), verify FSC/PEFC certificates against official registries using the 10-field visual screening checklist, audit historical performance data, and quarantine suspect inventory to ensure traceability before resuming operations.

Consider a scenario where a category manager notices corner collapse on boxes from the same supplier across three different carriers over six weeks. The pattern suggests the problem isn’t handling—it’s upstream. Investigation reveals the supplier changed linerboard sources without notification, and the new material runs slightly lower moisture resistance. The corrective lever isn’t a carrier claim; it’s a supplier change-control conversation and updated incoming inspection triggers.

Prevention: Bake Survivability into Sourcing

Prevention means translating incident learnings into enforceable requirements. Most fixes fail because they treat the symptom—shipping—instead of the cause: specification and control gaps. Reducing decision fatigue through defaults and evidence packs enables procurement teams to match rigor to risk without exhausting cognitive resources on every incident.

The Prevention Loop

Run this cycle every time:

- Diagnose the failure mode using the evidence pack and decision tree

- Capture the evidence in a standard format

- Translate the learning into a measurable requirement (what must be true)

- Control the supplier system through qualification, acceptance criteria, and change governance

- Verify on arrival for high-risk SKUs with incoming inspection focused on known failure modes

Turn “Upgrade the Grade” into Specific Requirements

Update specs to reflect real hazards. If humidity is the recurring theme, add a moisture content window or Cobb requirement. If compression failures dominate, revisit ECT targets and conditioning assumptions. Specifications should describe the environment the box must survive, not just the box you want to purchase.

Depending on the pattern, tighten the requirement that actually drives survivability:

- Compression survivability: Define stacking assumptions and verify finished-box capability. ASTM D642 is commonly referenced for box compression testing.

- Distribution hazards: Use an agreed test plan for development or change events. ASTM D4169 is widely used as a lab sequence reference for distribution elements.

- Transit procedures: ISTA publishes test procedure families used to evaluate packaged-product performance.

These references illustrate the approach; thresholds and methods vary by product, lane, and risk tolerance. Resources like the quality blueprint for corrugated box specs can help translate performance needs into testable requirements.

Build lightweight qualification and incoming checks for high-risk SKUs. A caliper for thickness verification, a moisture meter for board condition, and a documented dock-side verification protocol can catch drift before it causes damage. Critical intake checks—such as seal verification, moisture screening, and core press-tests—completed while the driver is present preserve claim leverage and prevent acceptance of compromised material. Establishing a standardized ‘gatekeeper’ protocol ensures that visible exceptions are logged before liability transfers.

Align pack-out and palletization rules with the box’s actual load paths. The box’s rated strength assumes specific conditions. If your pack-out process overfills, overstacks, or under-wraps, you’re invalidating the specification. Make sure warehouse instructions match the assumptions built into the box design. Aligning procurement and engineering priorities through a shared RFQ checklist prevents the 23% quote spreads that emerge when stakeholders use different requirements.

The SME Pivot: When Price-Only Sourcing Stops Working

Price-only sourcing—”get three quotes and pick the cheapest that meets the grade”—can look fine at lower volumes with manual packing. When high-speed automation is introduced or production volume reaches significant scale—often observed when usage exceeds tens of thousands of units monthly, depending on the industry—organizations typically find that machineability specs (flatness, moisture stability, caliper consistency, reliable converting) matter more than unit price. At these volumes, the cost of downtime caused by material variance often outweighs per-unit savings. A single line stoppage from an inconsistent board can cost more than the per-unit savings.

This is the point to pivot to spec-true sourcing: treat machineability and consistency controls as sourcing requirements, not downstream firefighting. Strategic corrugated box sourcing systems that pre-qualify suppliers and contract with reorder triggers avoid the 15-25% emergency freight premiums that panic-buying creates. At scale, the cost of variability dominates unit price—and single-sourcing concentrates risk through continuity failures and lost leverage that a 30-90 day diversification blueprint can systematically address.

De-Escalate the Blame Game with Shared Evidence

The blame triangle persists because each party uses different data and definitions. When operations says “the box was crushed,” the carrier says “it was loaded wrong,” and the supplier says “it met spec,” no one speaks the same language.

The minimum evidence pack and diagnostic framework give everyone a shared reference point. Instead of arguing about fault, you can point to the failure mode, walk through the likely causes together, and land on the most appropriate corrective lever. When evaluating new suppliers during corrective sourcing, seven questions that scammers can’t answer provide a twelve-minute verification protocol for legal entity confirmation and capability evidence.

This doesn’t eliminate disputes entirely, but it changes their character. Conversations shift from “whose fault is this?” to “which upstream change prevents recurrence?” Procurement leaders who can defend decisions with evidence—not opinions—build credibility across the organization and with external partners.

When incidents are documented consistently, every function argues from the same story. A shared evidence pack and decision tree create a common diagnostic language that makes accountability fairer and corrective action faster.

Recurring damage on arrival signals that your corrugated box sourcing system needs recalibration. Start with diagnosis, standardize your evidence, feed every incident back into specs and supplier controls, and stop treating packaging as a commodity that just needs to be cheaper. That’s how you move from reactive claims to resilient supply chains.

For more frameworks on specification development, supplier verification, and incoming quality protocols, explore PaperIndex Academy. Buyers can also submit RFQs to receive quotes from verified corrugated box suppliers across the PaperIndex global network.

Disclaimer: This content is educational and informational only. All testing decisions, specifications, and supplier agreements should be based on your specific operational requirements and professional judgment.

Our Editorial Process:

Our expert team uses AI tools to help organize and structure our initial drafts. Every piece is then extensively rewritten, fact-checked, and enriched with first-hand insights and experiences by expert humans on our Insights Team to ensure accuracy and clarity.

About the PaperIndex Insights Team:

The PaperIndex Insights Team is our dedicated engine for synthesizing complex topics into clear, helpful guides. While our content is thoroughly reviewed for clarity and accuracy, it is for informational purposes and should not replace professional advice.